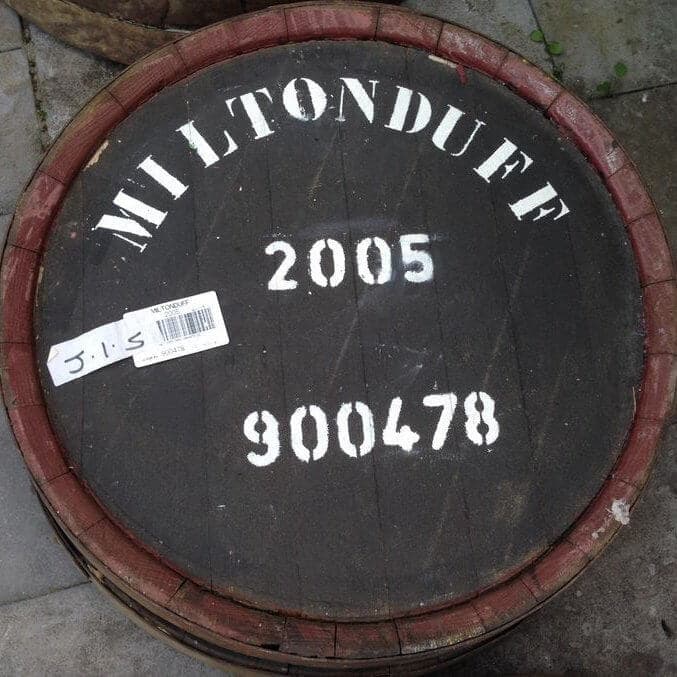

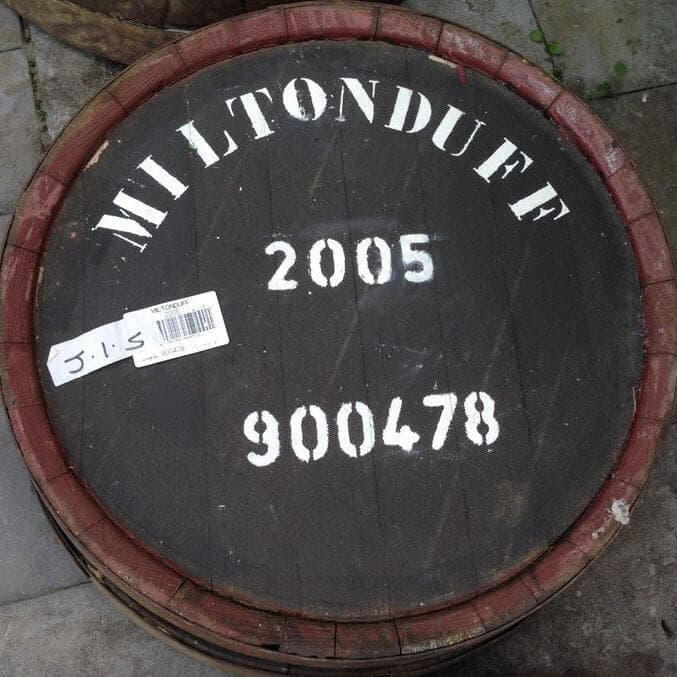

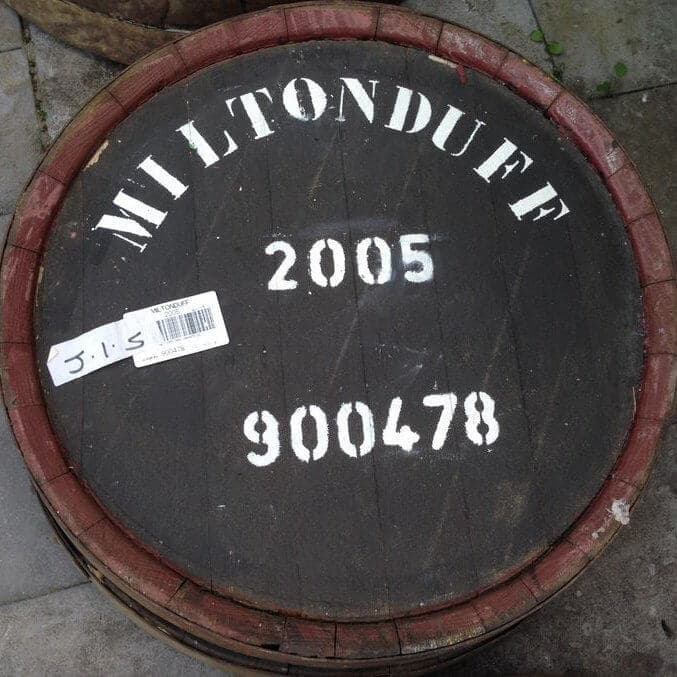

Miltonduff Distillery

Distillery key information

| Location | Speyside, Scotland, UK |

|---|---|

| Established | 1824 |

| Owner | Pernod Ricard |

| Number of Stills | 3 wash, 3 spirit |

| Visitor Centre | No |

| Status | Active |

| Website | N/A |

About Miltonduff Distillery

Founded in 1824 by Andrew Peary and Robert Bain, Miltonduff Distillery is a prominent Scotch whisky producer situated in Speyside, Scotland. Renowned for its light, fruity character and traditional craftsmanship, Miltonduff has established itself as a key player in the blended whisky market, while offering potential for single malt enthusiasts. A legacy of nearly two centuries, paired with operational efficiency, positions Miltonduff as an attractive asset for investors in the expanding whisky sector.

Located six miles south-west of Elgin on a historic site once linked to Pluscarden Abbey, Miltonduff’s annual production capacity stands at approximately 5.8 million litres, focusing primarily on spirit for blends. The distillery draws water from the Black Burn, employing six stills to create a versatile, unpeated whisky with notes of citrus, orchard fruits and subtle spice. Production blends heritage methods with modern innovations, including a 2022 expansion featuring sustainable facilities to boost output and efficiency.

Brand reputation and market presence

Miltonduff is synonymous with quality Speyside whisky, integral to Ballantine’s blend, which sold around 9.3 million cases in 2024 and continues to show strong growth. While single malt releases are limited, often through independent bottlers, the brand has earned recognition for its floral and fruity profile, winning accolades in such worthy competitions as the World Whiskies Awards.

Globally, Miltonduff benefits from Ballantine’s robust presence in Asia, Europe and emerging markets such as India and the Middle East.

Secondary market activity reflects Miltonduff’s investment appeal. At 2024 auctions, expressions including the 2013 hogshead were estimated at £5,000–£8,000, reflecting scarcity and collector interest. The casks are described as having potential for further complexity in maturation, appealing to collectors due to scarcity.

In 2024, a Miltonduff 2009 13-year-old single malt was listed at retail for £110 at The Whisky Exchange, with an ex-VAT price of £91.67. Auction data indicates an average ex-tax price of $131 per 750ml for this expression in 2024, reflecting strong secondary market interest. Older Miltonduff vintages, such as a 1966 23-year-old Sestante (Antica Casa Marchesi Spinola), fetched £2,355–£2,700 at Whisky Auctioneer between 2022 and 2023, demonstrating significant premiums for rarer, aged expressions.

The brand’s under-pricing relative to quality, combined with rarity, makes it a sought-after choice for cask investors, with VCL clients who sold their Miltonduff casks during the 2020-2025 period seeing delivery of an average annualised return of 10.68%.

Financial performance

As part of Pernod Ricard, Miltonduff contributes to a portfolio delivering resilient results amid market volatility. Pernod’s FY24 net sales reached €11.6 million, with a 4% organic decline but strong contributions from premium brands. Profit from recurring operations stood at €3,1 million, down 7%, while group net profit was €1.5 million.

In H1 FY25, sales totalled €6.2 million, an organic decline of 4%, driven by economic pressures but offset by growth in Ballantine’s and other Scotch whiskies. Ballantine’s showed good performance, with year-on-year volume growth in key markets.

Pernod’s operating profit for FY24 rose amid increased investments and the company projects mid-term organic sales growth of 3–6% from FY27, supported by expansions like Miltonduff’s £88 million upgrade. While specific figures for Miltonduff are not disclosed, its role in Ballantine’s, Pernod’s growth driver, suggests solid margins and future upside.

Investment summary

Miltonduff Distillery presents a compelling investment case, fuelled by its heritage, scarcity and integral role in global blends like Ballantine’s.

Blending traditional production with sustainable innovations and strong market demand, Miltonduff leads in the Speyside category. Average historical cask appreciation of over 10%, alongside robust secondary market performance, highlights its potential. Financially, contributions to Pernod Ricard’s €11.6 billion FY24 revenue and projected growth illustrate its stability.

Despite risks such as market downturns and regulatory changes, Miltonduff’s rarity, worldwide appeal and strategic initiatives position it for continued value appreciation.

Let's find the right casks for you.

Our team will guide you through every step, from strategy to exit.

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.