Glenlivet Distillery

Distillery key information

| Location | Speyside, Scotland, UK |

|---|---|

| Established | 1824 |

| Owner | Pernod Ricard |

| Number of Stills | 7 wash, 7 spirit |

| Visitor Centre | Yes |

| Status | Active |

| Website | https://theglenlivet.com |

About Glenlivet Distillery

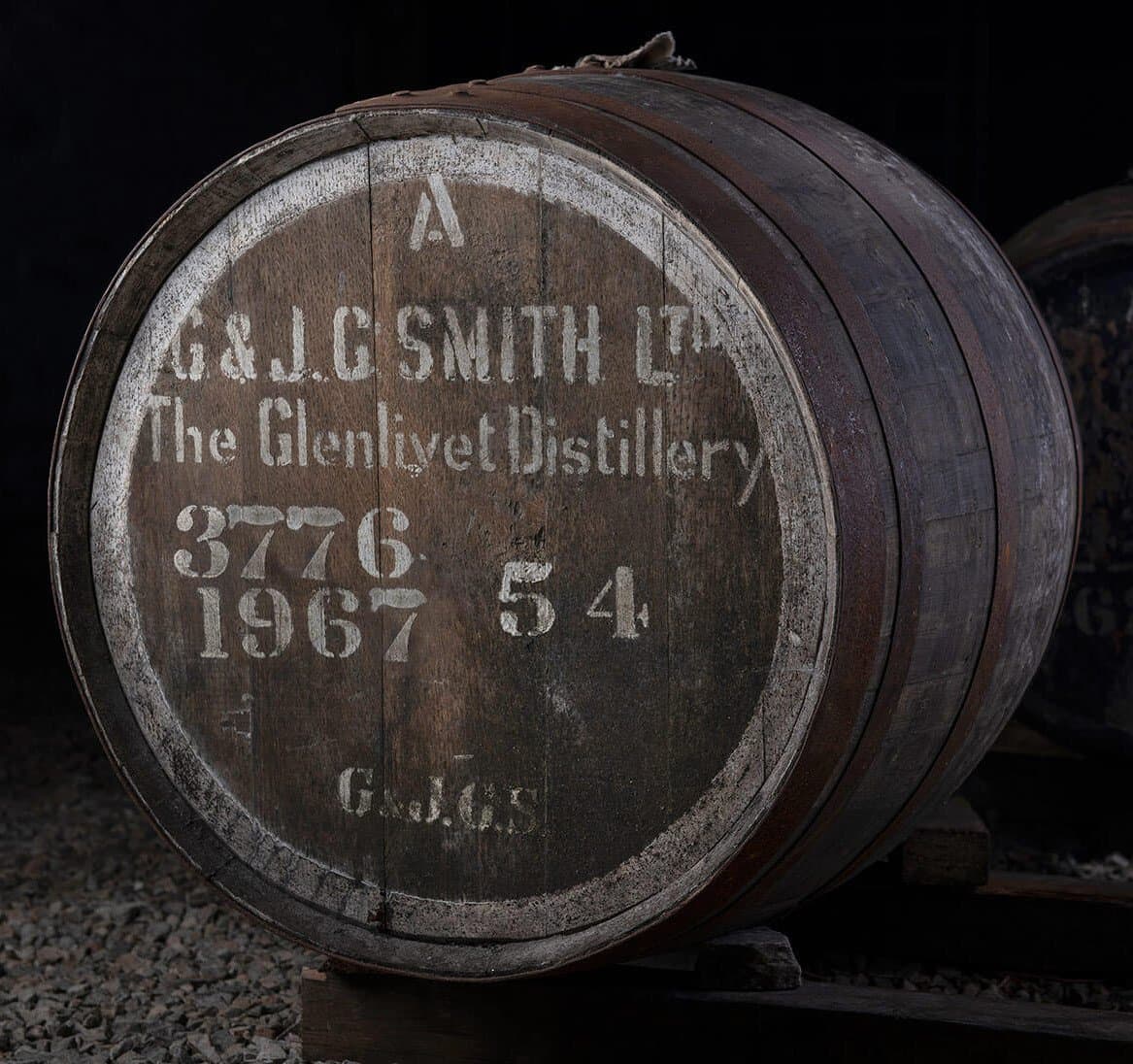

Founded in 1824 by George Smith, The Glenlivet Distillery in Ballindalloch, Speyside, Scotland, is a cornerstone of the single malt whisky industry. As the first distillery to secure a legal licence in Speyside, it set the standard for smooth, fruity and balanced whiskies. Owned by Pernod Ricard, a global leader in premium spirits, The Glenlivet blends traditional craftsmanship with cutting-edge innovation, positioning it as a top-tier choice for investors seeking exposure to the booming whisky investment market.

Situated in the heart of Speyside, The Glenlivet boasts a production capacity of approximately 21 million litres annually, one of the largest for single malt whisky, following expansions in 2010 and 2018. Its meticulous production process, deploying lantern-shaped stills, extended fermentation and a variety of cask types (bourbon, sherry and French oak) ensures a versatile and refined flavour profile.

Brand reputation and market presence

The Glenlivet is synonymous with Speyside elegance, renowned for its approachable yet sophisticated single malts. Core expressions, such as the 12 Year Old, 18 Year Old and Founder’s Reserve, consistently achieve ratings of 85–88 on Whiskybase, reflecting their quality and broad appeal. Limited releases, like the 50 Year Old from the Winchester Collection, command significant attention among collectors, further solidifying the brand’s prestige.

Globally, The Glenlivet maintains a dominant presence in key markets, including North America (the largest single malt market), Europe and Asia, with notable growth in emerging markets like India and China, driven by rising demand for premium single malts. Pernod Ricard’s strategic marketing positions The Glenlivet as a luxury brand, with prices 15–25% higher than comparable Speyside whiskies.

Investment potential

The Glenlivet’s investment potential is underpinned by its rarity, brand strength and robust secondary market performance. Secondary market activity highlights its appeal, with a high level of finished and live auctions reflecting high liquidity and collector interest.

At auctions, rare expressions achieve significant returns. For example, a 50-year-old Winchester Collection bottle fetched upwards of £25,000 in recent years, while a 1995 First Fill Sherry Butt (28 years old) was valued at £60,000–£80,000, commanding a premium over comparable Speyside casks.

The secondary market for bottles, such as the 18 Year Old and limited-edition Archive releases, shows consistent price growth, with trading volumes indicating sustained investor interest. Cask investments, requiring higher capital and 5–10-year holding periods, offer significant potential, especially for casks with naming rights, which enhance resale value.

Financial performance

As a flagship brand within Pernod Ricard’s portfolio, The Glenlivet significantly contributes to the group’s financial performance. Pernod Ricard’s 2024 Annual Report (year ending June 30, 2024) reported total revenue of €11.6 billion, with organic sales growth of 2.2%, driven by a 7% increase in the premium spirits segment, including Scotch whisky. Operating profit reached €3.1 billion, up 3% organically, supported by strong performances from high-margin brands like The Glenlivet.

The Glenlivet’s limited-edition releases, such as the 50 Year Old Winchester Collection (retailing at ~£30,000), consistently fetch premium prices, reinforcing its profitability. Pernod Ricard’s focus on high-quality casks and controlled production volumes ensures stable margins despite rising supply chain costs. The company’s €100 million investment in Speyside, including distillery upgrades and sustainability initiatives, signals confidence in The Glenlivet’s growth, with a projected 5% output increase by 2027.

Investment summary

The Glenlivet Distillery presents a compelling investment opportunity, blending a storied heritage, global appeal and Pernod Ricard’s strategic oversight. Its smooth, versatile single malts and premium brand positioning ensure sustained demand. Historical cask appreciation rates of 8–12%, coupled with strong secondary market liquidity (~20,000 auction lots), illustrate its investment potential. Financially, The Glenlivet’s contribution to Pernod Ricard’s €11.6 billion revenue and 3% profit growth in 2024 highlights its stability and growth trajectory.

Available casks

Let's find the right casks for you.

Our team will guide you through every step, from strategy to exit.

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.