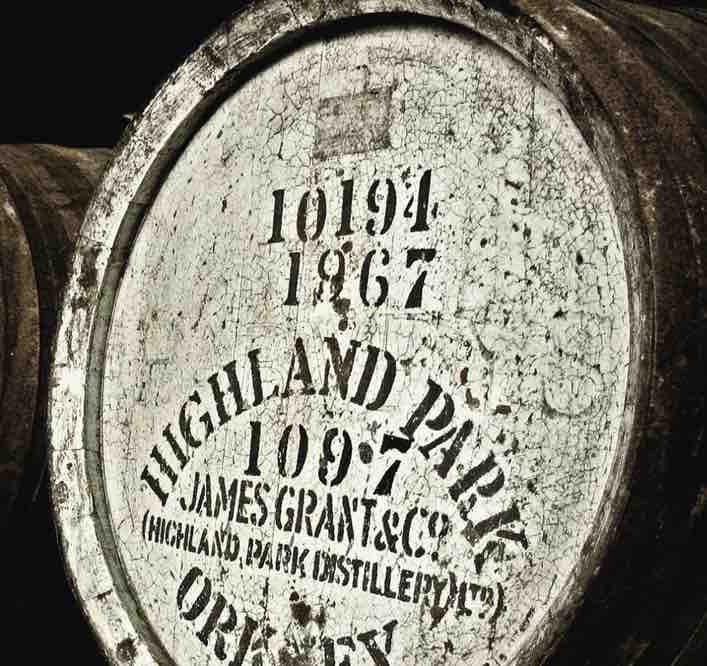

Highland Park Distillery

Distillery key information

| Location | Islands, Scotland, UK |

|---|---|

| Established | 1798 |

| Owner | The Edrington Group |

| Number of Stills | 2 wash, 2 spirit |

| Visitor Centre | Yes |

| Status | Active |

| Website | https://highlandpark.com |

About Highland Park Distillery

Founded in 1798 by David Robertson in Kirkwall, Orkney, Highland Park is Scotland’s northernmost single malt Scotch whisky distillery. Celebrated for its Viking heritage and distinctive heather-peated malt, it crafts whiskies with honey, dried fruit and subtle smokiness, shaped by Orkney’s rugged climate.

Acquired by The Edrington Group in 1979, Highland Park blends modern innovation with traditional techniques such as hand-turned floor malting and local peat cut from Hobbister Moor, resulting in whisky of exceptional quality.

With a production capacity of 2.5 million litres annually, the distillery has shifted from supplying blends to focusing on premium single malts, positioning it as a prime opportunity for investors in the expanding luxury whisky market.

Its commitment to small-batch production and unique maturation processes enhances its appeal to discerning collectors.

Brand reputation and market presence

Highland Park’s reputation is rooted in its Orkney provenance and consistent excellence. For instance, in the 2025 World Whiskies Awards, Gold was awarded for Highland Park 2004 Single Cask. This built on previous year’s victories in these awards, which include category winner title for single malt in 2021.

Its flavour profile – rich with heather honey, orchard fruits, and gentle peat – has garnered critical acclaim, including Gold for a 2004 single cask at the 2025 World Whiskies Awards. The distillery’s Viking-themed storytelling, inspired by Orkney’s Norse history, resonates globally, with releases like Valkyrie enhancing its collectible allure.

Distributed across over 100 countries through Edrington’s robust networks, including direct channels in 16 markets, Highland Park’s core range (12-, 15-, 18-, and 21-year-olds) and limited-edition bottlings captivate connoisseurs and investors. Its expansion in Asia, particularly China, is driven by Edrington’s premium branding and tailored marketing, including exclusive duty-free releases and whisky club partnerships, positioning Highland Park as a leader in the luxury spirits segment. Collaborations with retailers and sustainable packaging further elevate its global prestige.

Investment potential

Highland Park offers a compelling whisky cask investment opportunity, driven by its scarcity, heritage and strong auction performance. VCL clients selling their Highland Park casks during the 2020-2025 period saw delivery of an average annualised return of 10.68%. A cask typically yields 500 bottles, with 2–3-year holding periods optimising returns.

Sherry-seasoned casks, prized for their rich, complex profiles, offer an accessible entry point with annual yields competitive with Macallan but at lower premiums. Highland Park Distillery’s focus on rare releases and growing demand in emerging markets strengthens its investment case.

Financial performance

As part of The Edrington Group, Highland Park’s financials are not separately reported, but Edrington’s 2025 fiscal results provide context. The group recorded £912 million in core revenue, down 10% due to cautious consumer spending, yet its ultra-premium portfolio, including Highland Park and The Macallan, showed resilience, with strong growth in Asia Pacific, particularly China.

Pre-tax profits fell 26%, but divestitures like The Famous Grouse have sharpened focus on high-margin brands. Investments in sherry cask maturation, sustainable production and Asia-centric campaigns bolster Highland Park’s growth trajectory. The distillery’s emphasis on rare releases and cask programs drives profitability, with limited bottlings commanding premium prices at auctions and secondary markets.

Investment summary

Highland Park Distillery stands out as a robust whisky cask investment, blending Viking legacy with premium innovation. Its multiple awards, high scores and unique Orkney character affirm its global desirability.

Edrington’s strategic focus on Asia and ultra-premium branding supports sustained growth, despite broader market challenges. Average historical cask appreciation of over 10% combined with strong demand for rare, sherry-finished expressions highlight its potential. Highland Park’s scarcity, storied heritage and expanding global footprint make it an attractive diversification opportunity in the thriving premium whisky market.

Let's find the right casks for you.

Our team will guide you through every step, from strategy to exit.

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.