Ardbeg Distillery

Distillery key information

| Location | Islay, Scotland, UK |

|---|---|

| Established | 1815 |

| Owner | LVMH |

| Number of Stills | 1 wash, 1 spirit |

| Visitor Centre | Yes |

| Status | Active |

| Website | https://ardbeg.com |

About Ardbeg Distillery

Ardbeg Distillery, founded in 1815, stands on Islay’s rugged south coast near Port Ellen, between neighbours Lagavulin and Laphroaig. Owned since 1997 by LVMH, via The Glenmorangie Company, it is celebrated as a global cult favourite among peat lovers. The site traces illicit distillation to 1794, with legal operations commencing under John MacDougall. After closing in 1981 during industry downturns, it was revived in 1989 by Hiram Walker, then fully restored under Glenmorangie in 1997 with Dr Bill Lumsden at the helm.

Ardbeg uses water from Loch Uigeadail and Loch Airigh Nam Beist, soft, peaty sources feeding two traditional copper stills: a 19,000-litre wash still and a 15,000-litre spirit still with unique purifiers that retain heavy, oily congeners. Fermentation lasts 70-plus hours in Oregon pine washbacks, using heavily peated barley at 54–55 ppm phenol from Port Ellen Maltings. Annual capacity is 2.4 million litres of alcohol, with production running 24/7 during peak seasons.

The distillery retains traditional floor maltings that are now symbolic and just used for special releases, worm tubs and dunnage warehouses. Visitor facilities include the award-winning Old Kiln Café, shop and immersive tours. The site spans 20 acres, including restored Victorian buildings and the iconic pagoda kiln.

Core range includes Ardbeg Ten (46% ABV, non-chill-filtered), Uigeadail (54.2%), Corryvreckan (57.1%) and An Oa (46.6%). Limited releases like Ardbeg Day bottlings and the Committee Release series command premium prices. In 2025, Ardbeg launched Traigh Bhan 19 Year Old Batch 7 and a Fèis Ìle 2025 expression matured in ex-Manzanilla casks.

Brand reputation and market presence

Ardbeg enjoys legendary status among whisky enthusiasts, often called “the peatiest, smokiest, most complex” Islay malt. It has won World’s Best Single Malt (World Whiskies Awards 2018, 2023) and consistently scores 90-plus on Whisky Advocate and Whiskybase. The Ten is lauded for “tar, iodine, citrus and bonfire” balance; Uigeadail and Corryvreckan regularly top blind tastings.

The Ardbeg Committee—a global fan club of 150,000 members—drives loyalty with exclusive releases and events. The brand’s dark, rebellious identity (“Untamed Spirit of Islay”) resonates in pop culture, from music festivals to luxury collaborations.

Globally distributed in over 100 countries, Ardbeg leads Islay’s premium segment. Strong in the USA, UK, France, Germany and Asia-Pacific, it dominates duty-free and specialist retail (The Whisky Exchange, Master of Malt). Annual visitor numbers exceed 100,000, making it Islay’s top tourism draw.

Investment potential

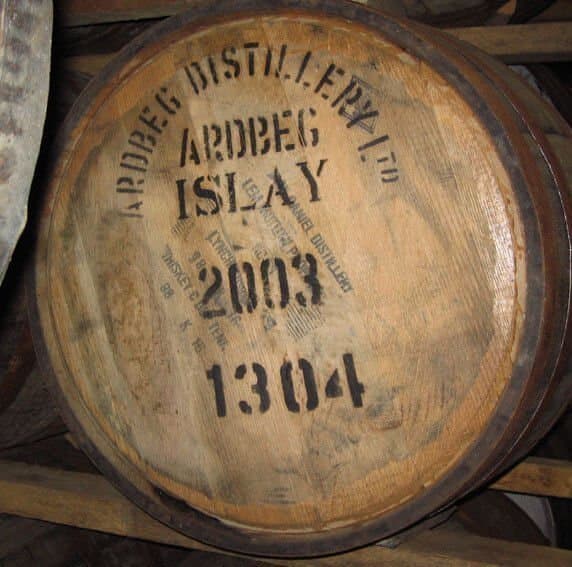

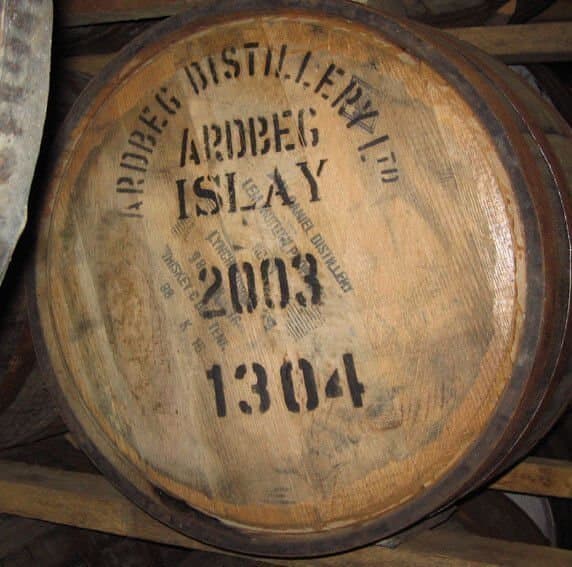

Investors who sold their Ardbeg casks via VCL Vintners between 2020 and 2025 saw average annualised appreciation rates of 17.74 per cent and demand often outstrips supply. Ardbeg Ten for instance frequently sells out and older vintages pre-2000 are blue-chip investments. Brand strength, scarcity and global cult status ensure long-term capital growth.

Ardbeg casks are rarely available to private buyers, most being retained for core and limited releases. Demand consistently outstrips supply: Ardbeg Ten frequently sells out, while pre-2000 vintages are now blue-chip assets.

Financial performance

As part of The Glenmorangie Company Ltd (owned by LVMH), Ardbeg’s individual financials are not publicly disclosed. However, LVMH’s 2024 Wines & Spirits division reported €6.4 billion revenue, with single malts led by Glenmorangie and Ardbeg showing 8% organic growth. Ardbeg contributes an estimated £150–200 million annually in sales, based on 2.4m litres production and average bottle price of £60–£120.Maturation stock exceeds 1.5 million casks, with 10–25-year-old parcels valued at £50–£100 million. Tourism generates £5–7 million/year (100k visitors @ £50–70 avg. spend). LVMH invested £30 million in Ardbeg’s 2017–2020 expansion, including new stills and warehousing.

Investment summary

Ardbeg is Islay’s undisputed peat king, a 200-year-old icon with unmatched reputation, global reach and financial muscle via LVMH. From core classics to rare vintages, it delivers consistent quality and investment resilience. Ideal for collectors and long-term investors seeking 10–20-year returns in a £5 billion premium Scotch market.

Let's find the right casks for you.

Our team will guide you through every step, from strategy to exit.

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.