Glenrothes Distillery

Distillery key information

| Location | Speyside, Scotland, UK |

|---|---|

| Established | 1878 |

| Owner | The Edrington Group |

| Number of Stills | 5 wash, 5 spirit |

| Visitor Centre | Yes |

| Status | Active |

| Website | https://theglenothes.com |

About Glenrothes Distillery

Established in 1878 by James Stuart & Co. in the whisky town of Rothes, Speyside, Glenrothes Distillery draws its name from the Earl of Rothes and harnesses the pure waters of the Rothes Burn for its elegant single malts. The first spirit flowed on 28 December 1879, marking the start of a legacy in unpeated whiskies noted for delicate fruit notes of pear, apple and honey, balanced by subtle oak and spice.

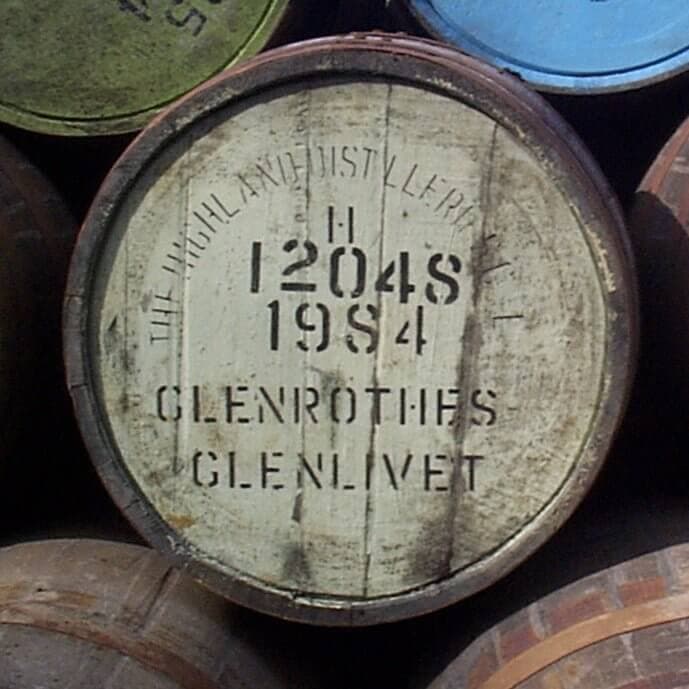

Acquired by Highland Distillers in 1887 and integrated into the Edrington Group in 1999, Glenrothes now forms a cornerstone of Edrington’s premium portfolio alongside The Macallan and Highland Park. With 10 stills promoting reflux for a refined spirit and long 55-60 hour fermentations, the distillery produces 5.6 million litres annually, over 80% of which supports popular blends such as The Famous Grouse, ensuring single malt scarcity. Its innovative “vintage” system releases whiskies at peak maturity, bypassing age statements, while an on-site cooperage maintains casks. Sustainability aligns with Edrington’s targets: 50% carbon reduction by 2030 and net zero by 2045, including estate biodiversity on 300 acres where wild orchids inspire limited editions.

Brand reputation and market presence

Glenrothes is revered as Speyside’s “most elegant whisky,” bridging accessibility and luxury with its fruity sophistication and vintage storytelling that captivates connoisseurs. Flagship vintages like the 1995 and 2001 score 88-92 on Whiskybase, with independents highlighting sherry cask versatility.

In 2025, the distillery unveiled The 51, a 51-year-old from two exceptional casks, limited to 100 smash-to-open crystal bottles at $48,000 each, praised for aromatic delicacy and marking a pivot from no-age-statement releases. The 15 joined the core range in May, matured in sherry-seasoned European oak for everyday appeal at around $100, lauded as a delicious, affordable surprise bucking premiumisation trends and enhancing accessibility. These complemented The 18 and redesigned 25-year-old, which featured in Robb Report’s top single malts. Sponsorship of the 2024 World Superyacht Awards elevated its luxury status. Edrington’s network spans 80+ countries, with robust growth in Asia, Europe and North America.

Virtual experiences and partnerships like Pelorus estate immersions engage global enthusiasts, as the market eyes 5% annual growth through 2030.

Investment potential

In Speyside’s value tier, Glenrothes’ limited single malt output amid blend dominance drives secondary market appreciation, with rare vintages like the 50-year-old fetching $35,000. The 25-year-old rose over 50% in value from 2019-2022, signalling strong fundamentals despite a 24% rare whisky volume dip in 2025. Edrington’s backing and vintage prestige yield 8-10% historical bottle returns, with cask ownership offering tax perks.

VCL clients selling Glenrothes casks from 2020-2025 averaged 11.41% annualised ROI, with 2013 at 11.69% and 2016 at 18.45%, boosted by sherry maturation.

Financial performance

Glenrothes underpins Edrington’s malt whisky resilience in a tough 2024/25. Core revenue fell 10% to £912 million (year to March 31, 2025), with contribution down 28% and pre-exceptional PBT 26%, amid economic pressures and cautious consumers. Brand investment rose to fuel expansion, while net debt hit £767 million on maturation spends; free cash flow stayed positive. Malt segments, including Glenrothes’ 2025 releases, outperformed blends, leveraging 15% Asian Scotch uptick and 30+ export markets. Sustainability efforts enhance margins, aligning with eco-trends in a 7% premium outperformance versus peers.

Investment summary

Glenrothes fuses Speyside elegance with vintaging innovation and sustainability, yielding above average cask ROI and 18.45% for 2016. This performance is driven by inherent scarcity: with approximately 98% of production allocated to prestigious blends like Cutty Sark, single malt releases remain limited, fuelling secondary market appreciation.

Edrington’s £912m revenue stability and accolades for The 51 further affirm the distillery’s prestige. Affordable, fruity and globally positioned, it’s a high-potential asset in premium Scotch’s resilient market.

Let's find the right casks for you.

Our team will guide you through every step, from strategy to exit.

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.