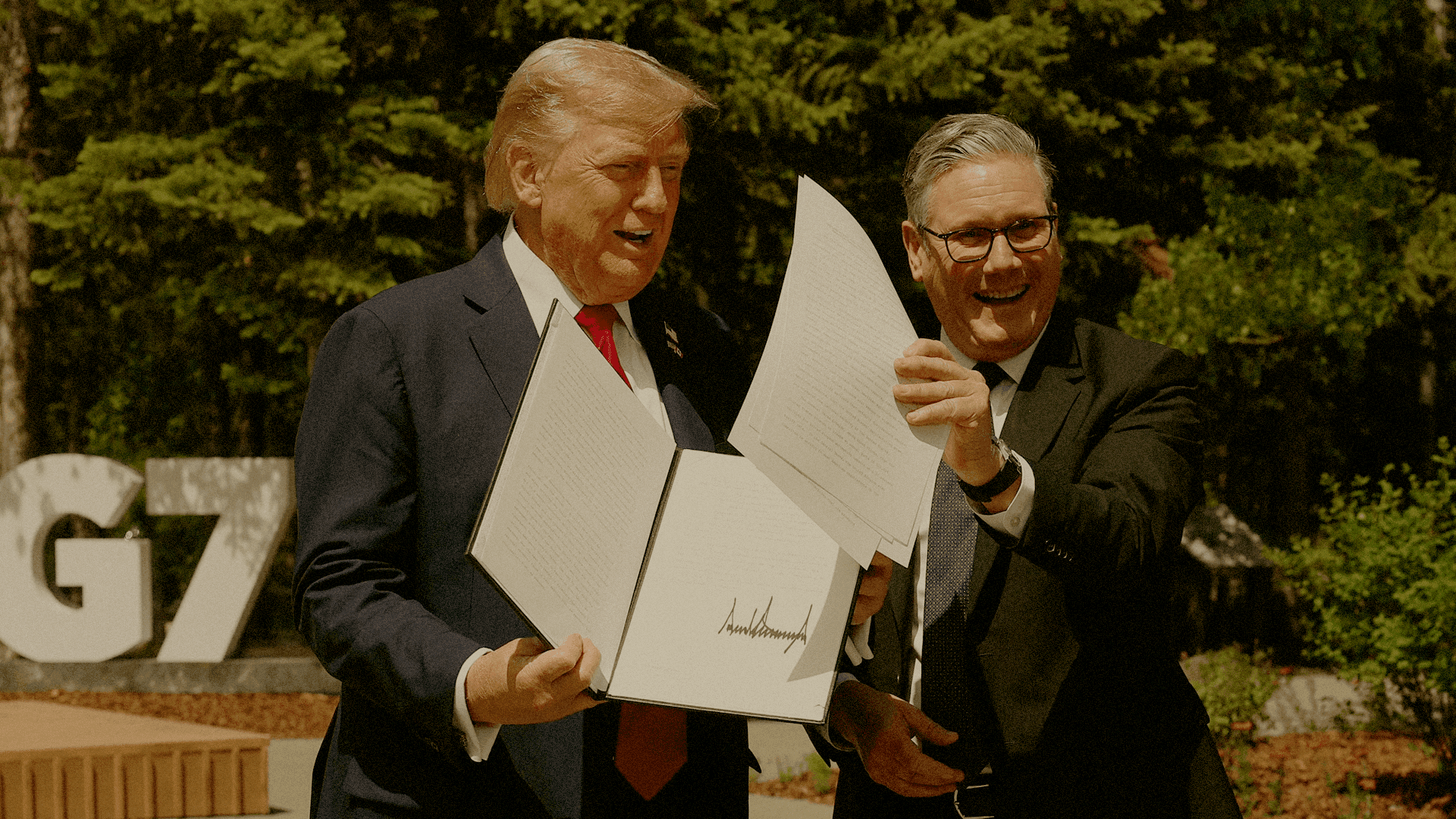

The global spirits industry is facing major trade tensions between the United States and the European Union. On 13 March 2025, President Donald Trump announced a potential 200% tariff on European wine, champagne, and spirits. This move is in response to the EU’s planned 50% tariff on American whiskey, which is part of a broader €26 billion retaliatory tariff package against US steel and aluminium tariffs.

At first glance, these policy shifts seem disruptive. However, for whisky cask investors, particularly those working with VCL Vintners, these developments could prove beneficial in several ways.

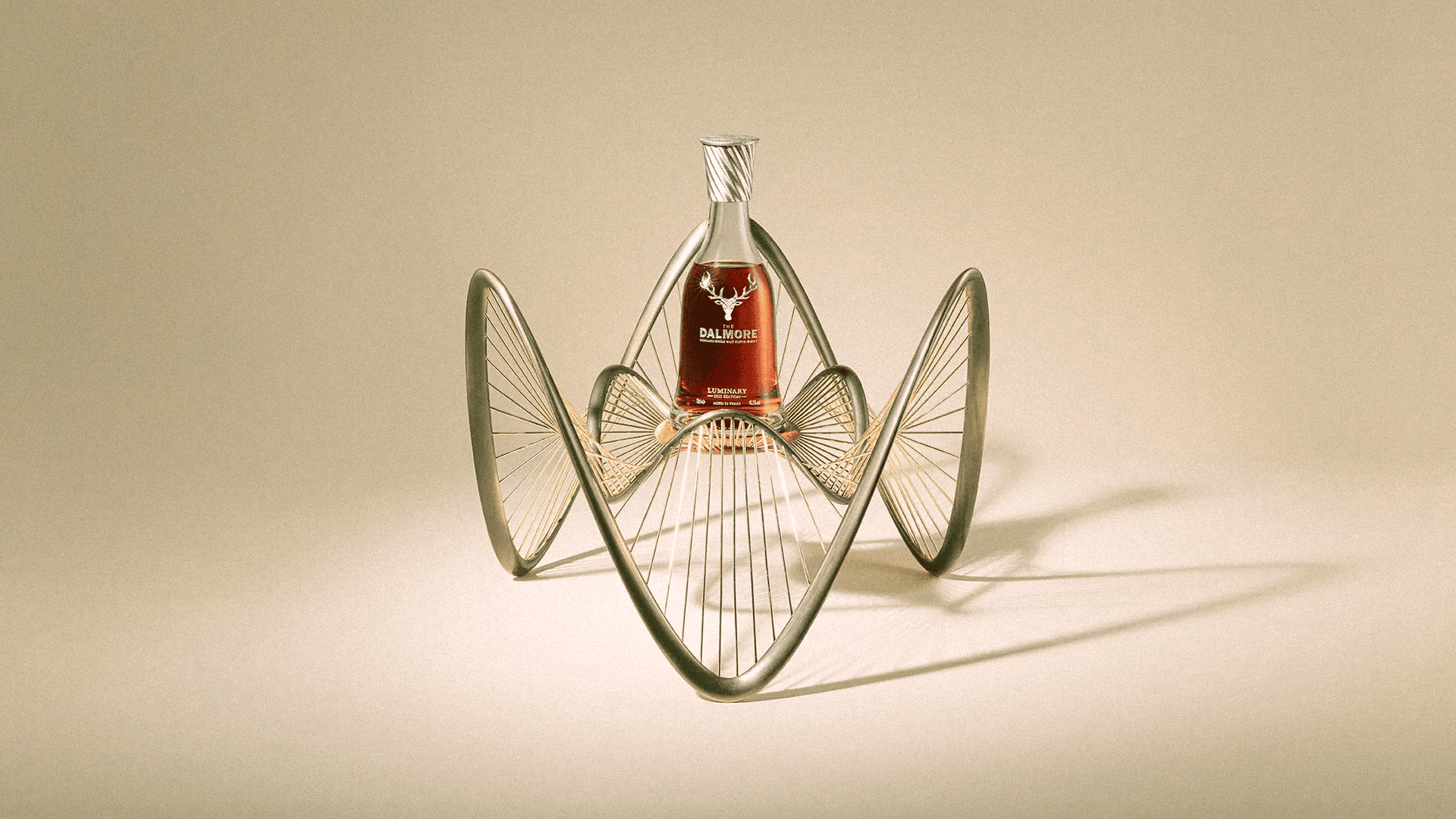

1. Reduced American Whiskey Supply in Europe = Higher Demand for Scotch

The 50% EU tariff on American whiskey is expected to significantly increase prices in Europe. As a result, many consumers and collectors may turn to Scotch whisky as a more accessible alternative.

This shift in demand benefits whisky cask investors, as greater consumption of Scotch whisky strengthens the market and may drive up the value of maturing casks.

2. European Spirits Becoming More Expensive in the US Could Boost Whisky’s Prestige

If the US imposes a 200% tariff on European wine and spirits, European producers will struggle to compete in the American market. However, luxury goods often thrive when scarcity increases perceived value.

With European wines and spirits facing reduced accessibility, premium aged whisky may become an increasingly desirable asset for US collectors and investors. This would further drive demand for well-matured whisky casks, making them a strong alternative investment.

3. Tax Efficiency of Whisky Casks Remains Unaffected

Unlike bottled whisky, whisky held in cask is not subject to alcohol duty until it is bottled and sold. This means that whisky cask investors are shielded from these rising tariffs and duties, keeping it a tax-efficient investment compared to bottled spirits.

Additionally, whisky casks in the UK are often classified as ‘wasting assets’, meaning they are generally exempt from Capital Gains Tax. Investors holding casks benefit from this unique tax advantage, further boosting potential returns.

4. Stability in a Volatile Market

Trade tensions like these highlight the uncertainty of global markets, but also reinforce whisky’s status as a stable alternative asset.

Unlike stocks or property, whisky casks appreciate naturally over time through maturation. Regardless of short-term market fluctuations, the value of well-aged whisky increases as it becomes rarer. Investors holding casks are well-positioned to benefit from this built-in appreciation.

Conclusion: Why These Trade Tensions Favour Whisky Cask Investors

While tariffs and trade restrictions may disrupt traditional spirits markets, they strengthen the case for whisky cask investment.

As American whiskey becomes more expensive in Europe, and European spirits face barriers in the US, Scotch whisky remains a strong, appreciating asset with increasing global demand.

For VCL Vintners’ clients, these market shifts reinforce the resilience and profitability of whisky cask investment—an asset class that not only retains value amid market volatility but also gains from these geopolitical developments.

Whisky cask investors aren’t just avoiding the impact of these tariffs; they are positioned to profit from them.

Let's talk whisky and spirits.

Connect with our team to explore investment opportunities.

Journal Highlights

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.