Whisky Investment Podcast Episode 7 – Behind the Scenes: 2024 in Retrospect with Benjamin Lancaster & Tommy Major

In this episode of The Whisky Investment Podcast, whisky journalist Alwynne Gwilt sits down with Benjamin Lancaster, co-founder and owner of VCL Vintners, and Tommy Major, Head Cask Trader, to explore the evolving world of whisky investment. With a portfolio under management of £150 million, VCL Vintners has a unique perspective on how global events, shifting investor sentiment, and changes in whisky availability have shaped the market. From the resilience of Scotch whisky to the rise of tequila as a new asset class, Ben and Tommy provide an insider’s view on where the industry stands today and what opportunities lie ahead in 2025.

Navigating the Whisky Investment Landscape: Insights from VCL Vintners

In this episode of The Whisky Investment Podcast, whisky journalist Alwynne Gwilt sits down with Benjamin Lancaster, co-founder and owner of VCL Vintners, and Tommy Major, Head Cask Trader, to reflect on the whisky investment landscape of 2024 and what’s in store for 2025. With global political changes, evolving investor sentiment, and shifts in whisky availability, Ben and Tommy provide an expert analysis of where the market stands and how investors can capitalise on emerging opportunities.

A Year of Political and Economic Shifts

2024 was a year marked by political change, with elections in the UK, the US, and several other major markets influencing investor confidence. Ben explains that during times of political uncertainty, investors often take one of two approaches—either they hold back and wait for stability, or they recognise opportunities in resilient markets like whisky investment.

“There was a sentiment where, although cash was available, it wasn’t moving as freely because of the uncertainty,” Ben says. “But towards the end of the year, when elections were settled, there was a shift—people started deploying capital again.”

Tommy highlights that investor education played a crucial role during this period, helping clients to understand how whisky investment has performed during past periods of economic uncertainty. “It’s about staying in contact with clients, keeping them informed, and showing them how whisky has weathered previous downturns.”

Scotch Whisky’s Continued Strength

Despite global shifts, Scotch whisky remains at the core of whisky investment. Ben emphasises that its long-standing reputation and proven performance make it a staple for investors.

“The pedigree of Scotch whisky is what makes it so stable,” he explains. “While availability can fluctuate, we saw a significant increase in stock towards the end of 2024, meaning more opportunities for investors to acquire high-quality casks.”

With a portfolio under management of £150 million, VCL Vintners continues to focus on sourcing premium Scotch casks, allowing investors to diversify their holdings and benefit from long-term appreciation.

Tequila: A Growing Investment Opportunity

Beyond Scotch, 2024 saw increasing interest in tequila as an alternative asset, particularly in the US. Tommy explains that while the investment model shares similarities with whisky, the key difference is the much shorter maturation period.

“With Scotch, clients are looking at a ten-year-plus investment, but tequila matures in around five years, which offers a different dynamic,” he says.

However, sourcing investment-grade tequila is a challenge, as producers can bottle and sell their liquid immediately. “The tequila market is growing fast, and demand is high. We receive stock in small allocations, and it sells out quickly,” Tommy notes.

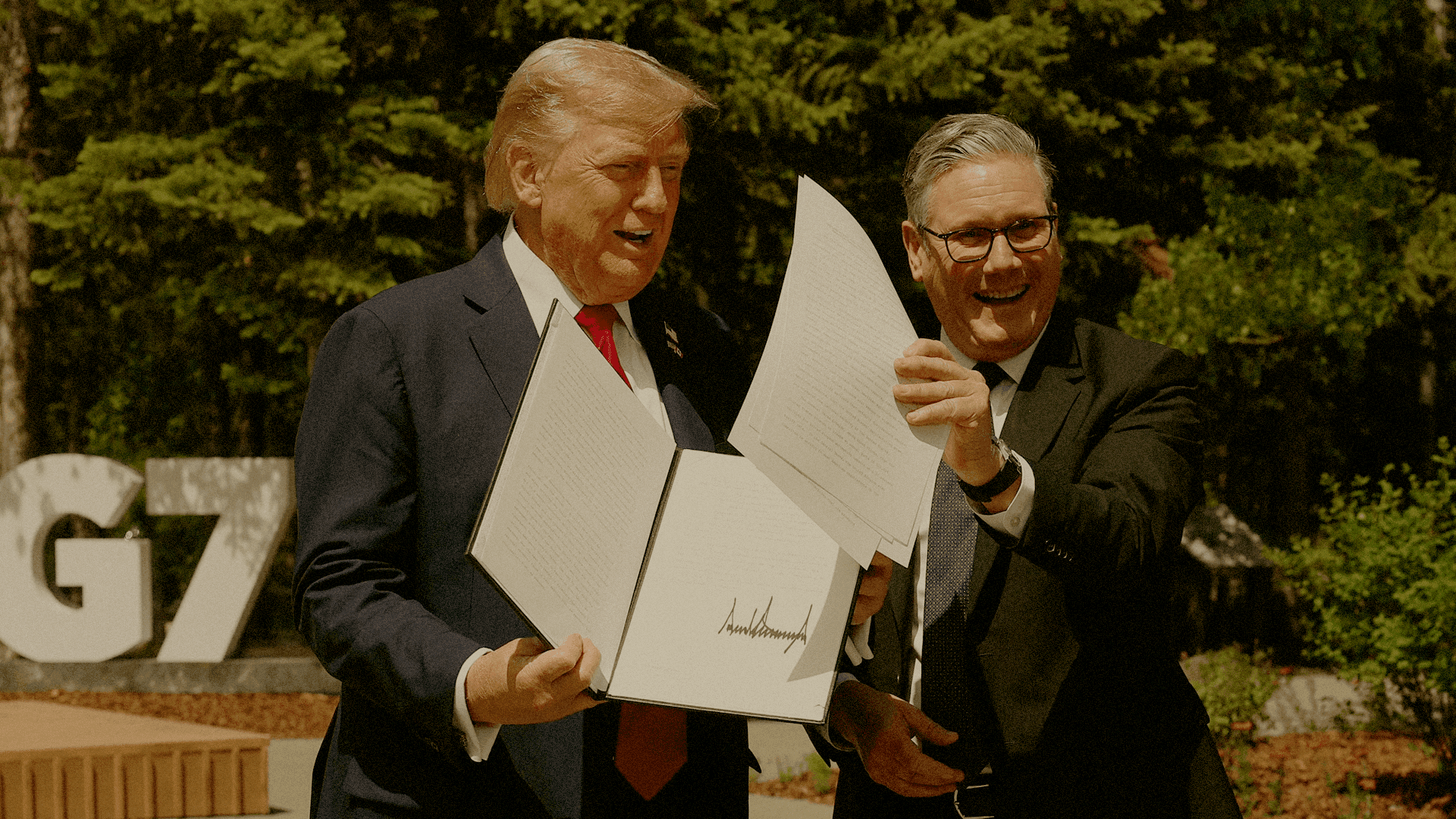

The Impact of UK and US Political Changes

The shift to a Labour government in the UK brought some key legislative changes, particularly in taxation. Ben points out that while there were concerns about how whisky might be affected, cask whisky investment remains unaffected by the new budget.

“The main taxation changes applied to bottled whisky, whereas whisky held in cask still benefits from its status as a wasting asset,” he says.

On the international stage, potential changes to US tariffs are being closely monitored. Tommy acknowledges that while new policies may be introduced, Scotch whisky enjoys a strong trade relationship with the US.

“The US is a huge market for Scotch, and there’s a trade-off with American bourbon,” he explains. “It wouldn’t make sense to impose heavy tariffs on Scotch if it leads to retaliatory measures on US exports.”

Looking Ahead to 2025

With greater political stability and renewed investor confidence, Ben and Tommy see 2025 as a year of opportunity. Some of the key trends they anticipate include:

✅ More availability of high-quality Scotch casks, allowing investors to acquire rare and aged stock.

✅ The continued expansion of alternative spirit investments, including tequila.

✅ The impact of reduced tariffs in markets like Hong Kong, which could signal further trade changes in the future.

✅ The ongoing negotiations around Indian whisky tariffs, which, if reduced, could unlock a major new market for Scotch.

For VCL Vintners, expansion into the US remains a key strategic focus, ensuring that investors have access to a broad range of opportunities in whisky cask investment.

Final Thoughts

Despite the challenges of 2024, whisky investment remains a resilient and attractive asset class. As Ben and Tommy highlight, understanding market trends, diversifying portfolios, and taking a long-term approach are key to success in 2025.

Whether you are an experienced investor or exploring whisky cask investment for the first time, this episode offers valuable insights into navigating the market. Be sure to tune in for the full discussion!

Let's talk whisky and spirits.

Connect with our team to explore investment opportunities.

Journal Highlights

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.