Spirit of Opportunity: What the UK-India Trade Deal Means for the Whisky Market

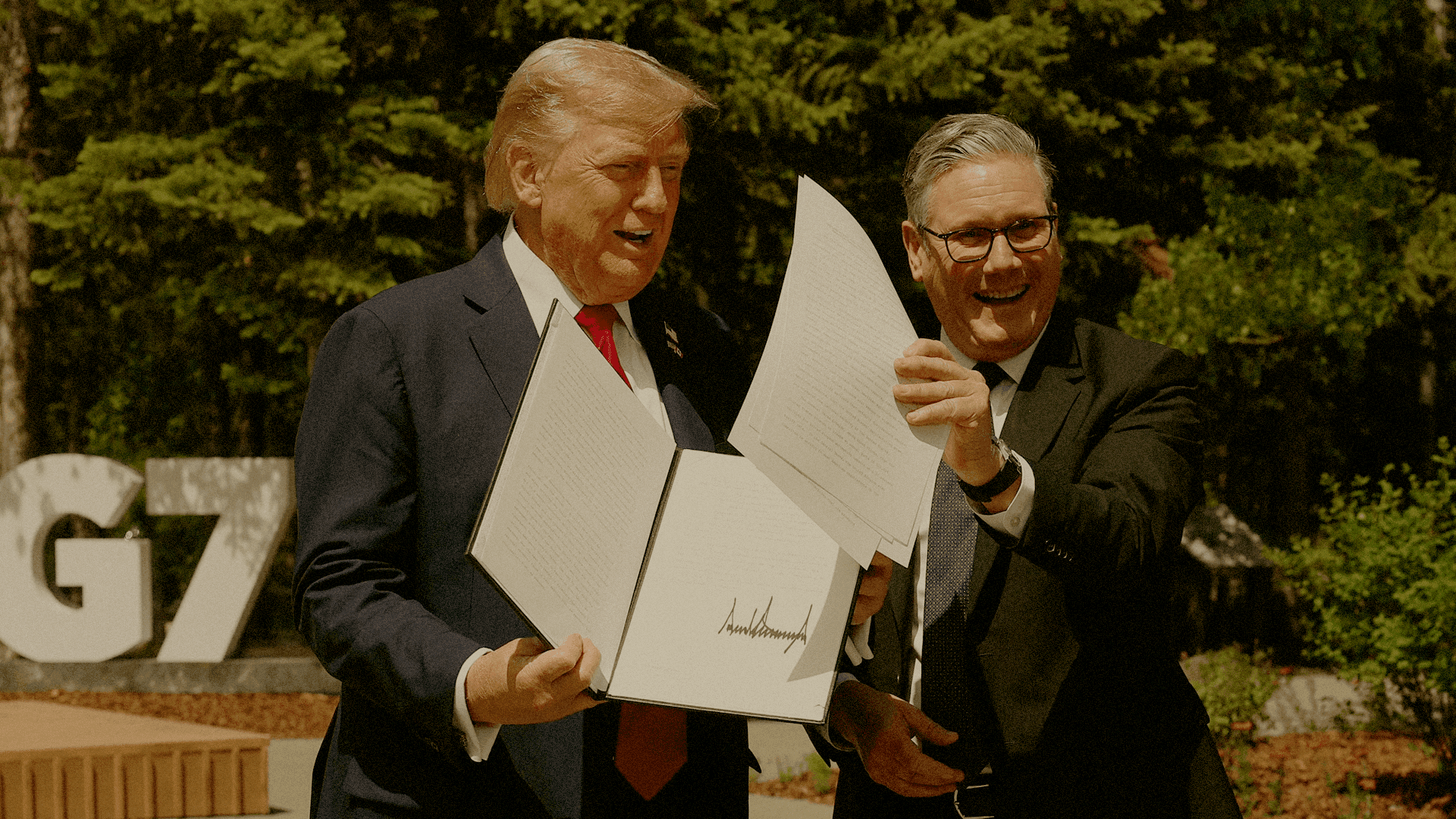

On 6 May 2025, the United Kingdom signed a landmark free trade agreement (FTA) with India — a move poised to transform the global Scotch whisky industry and redefine the long-term outlook for whisky investment. While Brexit-era trade deals have been under scrutiny, this agreement stands apart — not just for its economic scope, but for what it unlocks in one of the most coveted export markets for British luxury goods.

The Tariff That Held Back the Floodgates

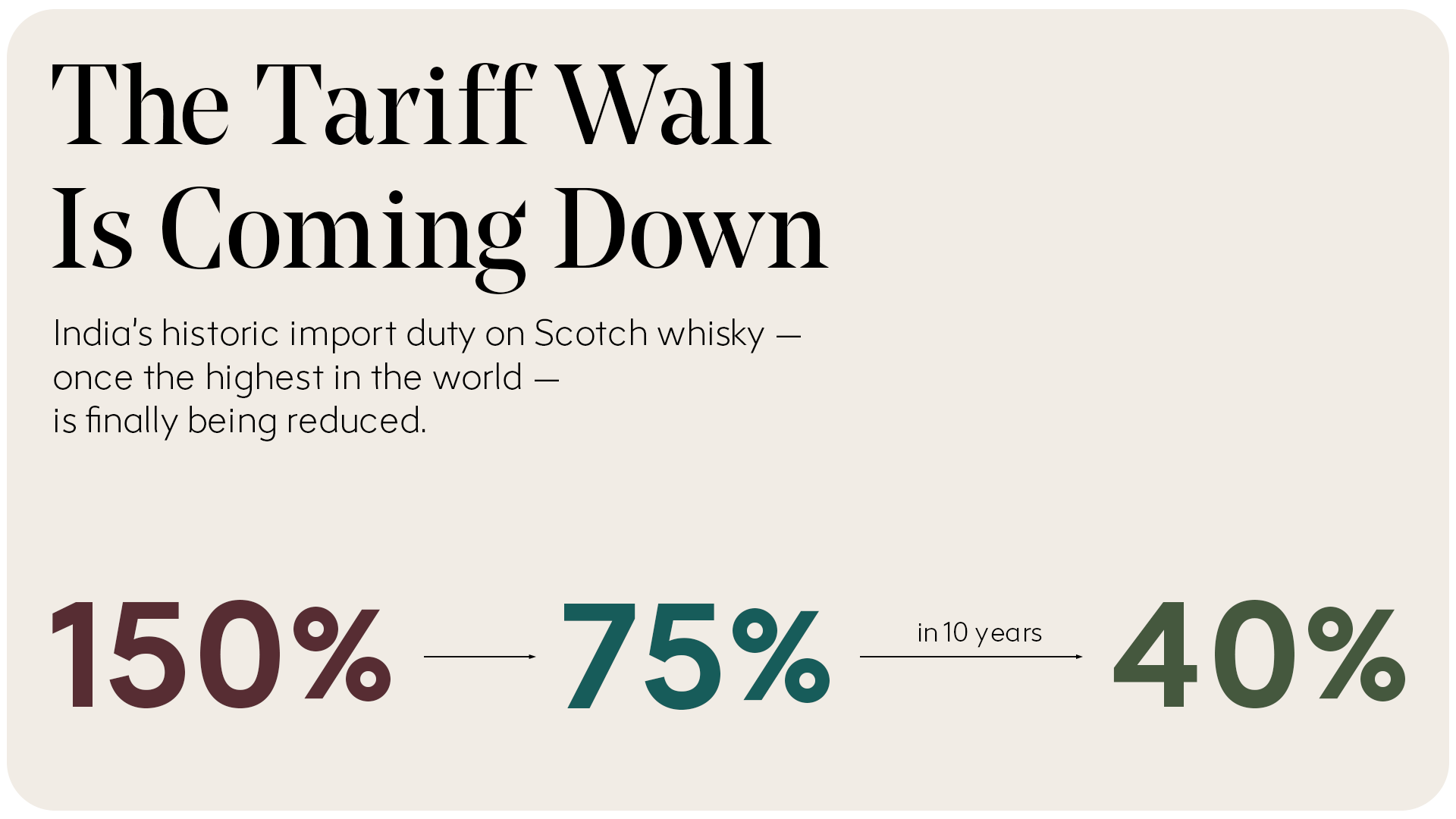

For years, Scotch whisky has faced a punishing 150% import tariff in India — a country that paradoxically consumes more whisky than any other in the world. This longstanding barrier effectively kept most premium Scotch expressions out of reach for the majority of Indian consumers. Now, that barrier is coming down. Under the new FTA:

The tariff on qualifying Scotch whisky will drop from 150% to 75%.

It will reduce further to 40% over the next decade.

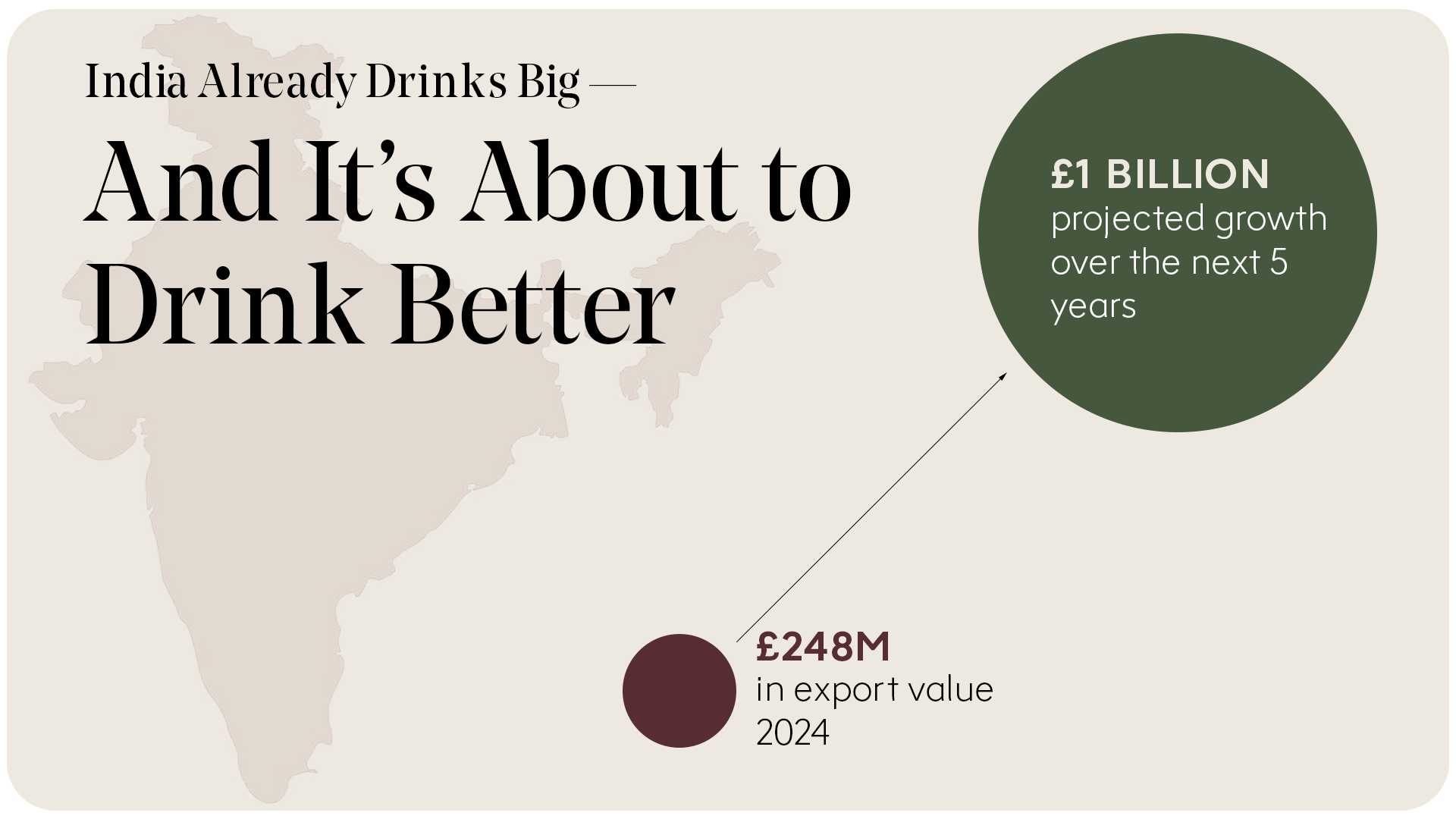

“The reduction of the current 150% tariff on Scotch Whisky will be transformational for the industry, and has the potential to increase Scotch Whisky exports to India by £1bn over the next 5 years.”

— Mark Kent, Chief Executive, Scotch Whisky Association

This is more than a trade facilitation — it’s a structural shift in accessibility, and a key driver of global demand over the next decade.

India: The Sleeping Giant Wakes

In 2024, India was already the largest export market for Scotch by volume, with over 192 million bottles shipped. In value terms, exports reached £248 million — placing India among the top-tier destinations for Scotch by revenue, despite the restrictive import environment. With the FTA now in effect, industry estimates project an additional £1 billion in Scotch exports to India over the next five years. This isn’t speculative growth — it’s the logical result of widening access to a young, aspirational market where demand for luxury, authenticity, and heritage spirits is on the rise. And that demand will not be limited to supermarket staples. It will encompass single malts, age-statement bottlings, and rare expressions — all categories directly linked to cask investment.

Why This Matters for Cask Investors

For investors holding single malt casks, the implications are profound.As India opens up and demand accelerates, the industry will be forced to respond. However, Scotch whisky production is not easily scaled. A cask laid down today will not be ready for bottling for at least 10–15 years. This inherent scarcity, combined with increasing global demand — particularly from India — is set to put upward pressure on the value of maturing stock.Simply put: the boom in the Indian market is going to have a significant impact on the global supply of Single Malt Scotch. As producers divert bottling stock to meet new export quotas, available supply for other markets will tighten — pushing cask values higher. For those already holding high-quality casks, this could mean a stronger resale position, higher bottling premiums, and more competitive acquisition interest from brands looking to meet demand.

Looking Forward: Timing the Market

The UK-India FTA is designed as a phased deal — a slow-burn benefit over 10 years. For investors, this offers a unique opportunity: the chance to acquire casks now, during the early years of this shift, while valuations are still catching up with future demand forecasts.Unlike other commodity markets, whisky rewards patience — and timing. Casks purchased in 2025–26 may very well reach optimal maturity at the exact moment India’s tariff reduction hits its lowest threshold. That alignment could prove highly lucrative.

Final Thoughts

This is not just a trade deal. It’s a pivotal realignment of one of Scotch whisky’s most promising markets. With tariff barriers lowered, cultural appetite rising, and distribution expanding across India, Scotch whisky is entering a new era of global relevance — and those holding maturing stock are perfectly placed to benefit.

At VCL Vintners, we believe the next decade of whisky investment will be shaped by access — and the India deal is the clearest signal yet that now is the time to act.

Let's talk whisky and spirits.

Connect with our team to explore investment opportunities.

Journal Highlights

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.