Tullibardine Distillery

Distillery key information

| Location | Highland, Scotland, United Kingdom |

|---|---|

| Established | 1949 |

| Owner | Picard Vins & Spiritueux |

| Number of Stills | 2 wash, 2 spirit |

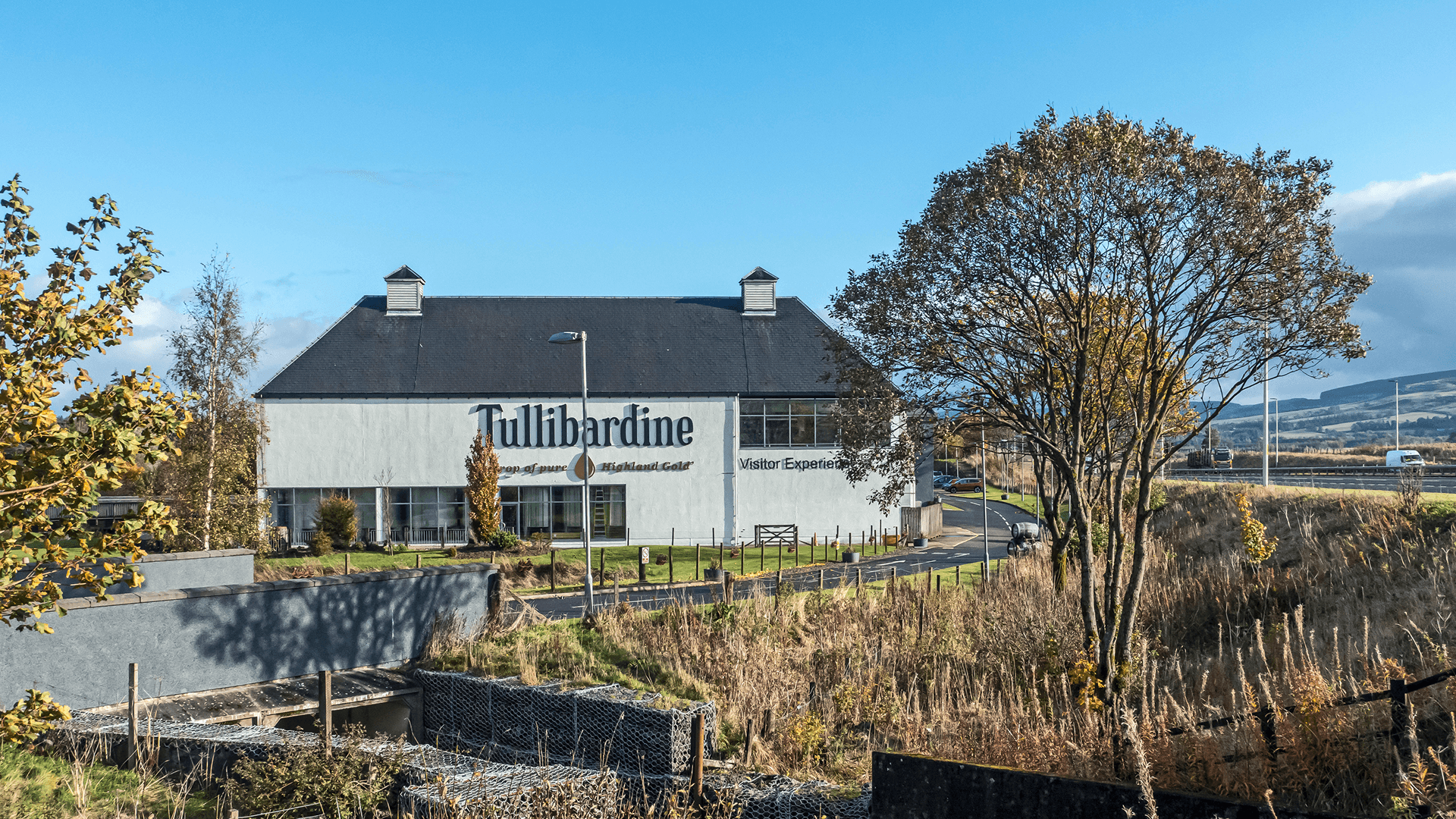

| Visitor Centre | Yes |

| Status | Active |

| Website | https://tullibardine.com |

About Tullibardine Distillery

Founded in 1949 in the serene hills of Blackford, Perthshire, Tullibardine Distillery stands as a distinguished Highland producer of single malt Scotch whisky, revered for its approachable yet sophisticated character. Acquired in 2011 by Picard Vins & Spiritueux, a global leader in premium spirits, Tullibardine seamlessly blends time-honoured craftsmanship with modern innovation.

Its rich heritage, versatile cask maturation and growing global allure position it as an accessible yet compelling choice for investors seeking high-potential returns in the flourishing whisky cask market.

Craftsmanship and production

Nestled in the heart of the Highlands, Tullibardine draws pristine water from the Danny Burn spring, crafting whiskies with vibrant fruity, malty and spicy notes. Its 3 million-litre annual production focuses on single malts, with a core range - Sovereign, 225 Sauternes Finish, 228 Burgundy Finish and 500 Sherry Finish - complemented by exclusives like the Marquess Collection. Matured in ex-bourbon, sherry and wine casks, its meticulous wood policy ensures exceptional quality through premium oak partnerships. A 2023 investment introduced energy-efficient stills and sustainable warehousing, cutting emissions by 15%.

An on-site cooperage enhances cask consistency, while a planned 2026 warehouse expansion will boost maturation capacity by 10%. These eco-conscious initiatives align with investor demand for sustainability, with green casks projected to command 5–8% premiums by 2030, elevating Tullibardine’s investment appeal.

Brand reputation and market presence

Tullibardine’s balanced, drinkable whiskies captivate connoisseurs, earning multiple accolades for their refined complexity. Distributed across over 40 markets, including Germany, Japan and North America, it leverages Picard’s robust global network. The 2022-upgraded visitor centre, set for further enhancements in 2025, welcomed thousands in 2024, driving direct sales and brand prestige. Asia’s 15% surge in premium whisky demand in 2024, led by Japan and China, alongside North America’s 12% single malt sales growth, serve to emphasise Tullibardine’s rising global influence. Its diverse cask finishes resonate with collectors, cementing its status as a Highland gem.

Investment potential

Tullibardine’s limited production, with only a fraction bottled as single malt, creates scarcity that fuels investment value. Older expressions fetched £500–£1,500 at 2024 auctions, yielding 50–100% premiums over retail. VCL clients who sold their casks between 2020-2025 saw an average annualised return of 14.48%, affirming Tullibardine’s collectability. Sauternes and Burgundy finishes align with Asia’s 20% demand growth for unique profiles, while North America bolsters prospects.

Sustainability enhances ESG appeal, with eco-friendly casks adding value. Competition from Highland peers like Glenmorangie and Oban, plus potential US/EU tariffs, poses risks, but Picard’s expertise ensures resilience. Investors should consult specialists like VCL Vintners for optimal cask selection.

Financial performance

As part of Picard Vins & Spiritueux, Tullibardine contributes to €450 million in 2024 revenue, up 12% from 2023, driven by premium spirits. High-margin limited releases and direct-to-consumer sales via e-commerce and the visitor centre fuel growth. Investments in sustainable infrastructure and the 2026 warehouse expansion enhance efficiency.

Despite economic and trade risks, Picard’s diversified markets ensure stability, positioning Tullibardine as a robust investment choice.

Investment summary

Tullibardine Distillery offers a compelling investment case, blending heritage, craftsmanship and accessibility. Its scarce casks, commanding 50–100% auction premiums and diverse finishes drive value. Picard’s €450 million revenue and 12% growth in 2024 underpin stability. With soaring demand in Asia and North America, plus ESG-aligned production, Tullibardine promises strong returns. Guided by experts like VCL Vintners, it shines as a Highland jewel for investors seeking sustainable, high-potential assets in the premium whisky market.

Let's find the right casks for you.

Our team will guide you through every step, from strategy to exit.

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.