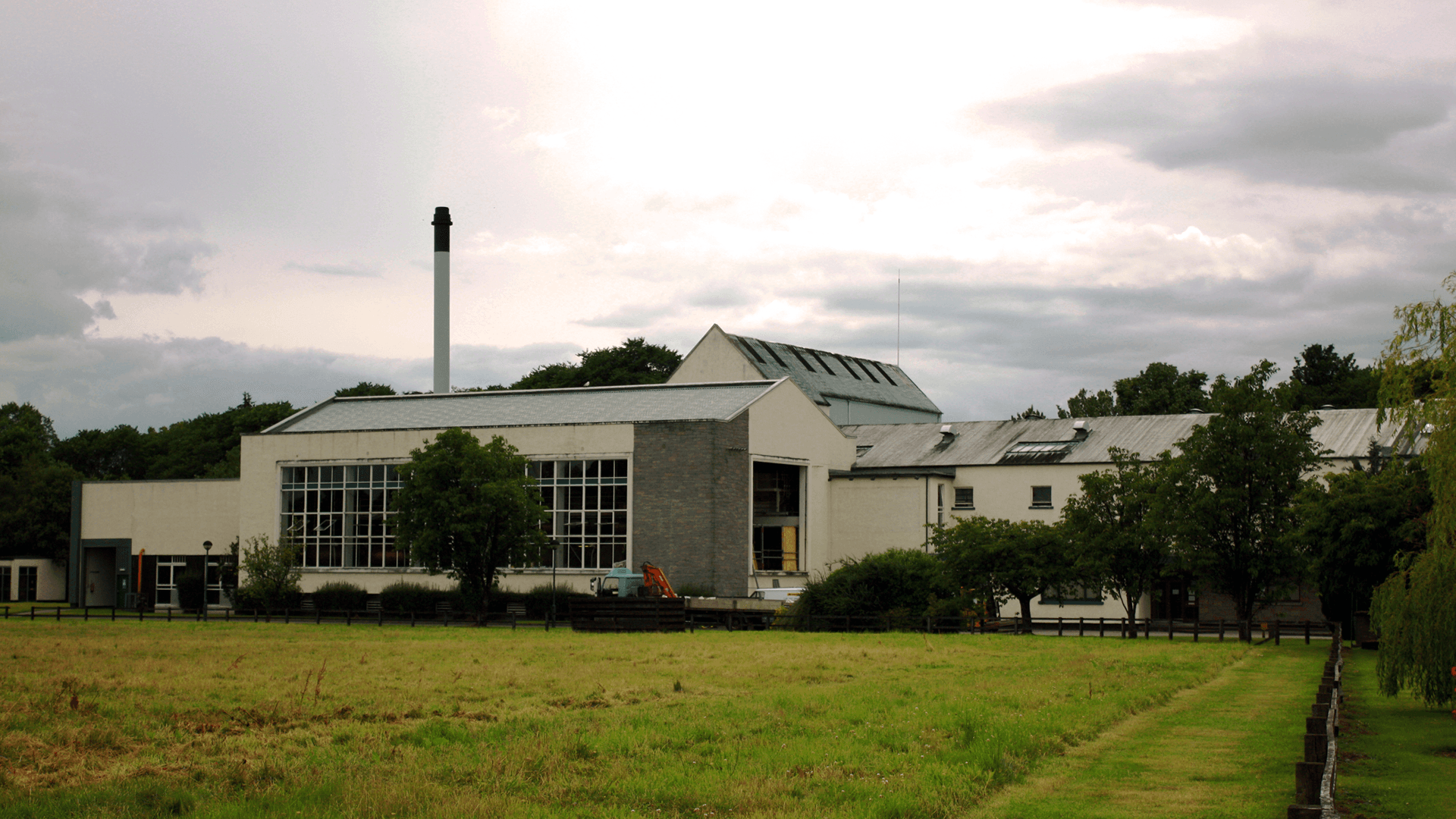

Teaninich Distillery

Distillery key information

| Location | Highland. Scotland, UK |

|---|---|

| Established | 1817 |

| Owner | Diageo |

| Number of Stills | 3 wash, 3 spirit |

| Visitor Centre | No |

| Status | Active |

| Website | N/A |

About Teaninich Distillery

Teaninich Distillery, nestled near the village of Alness in the Scottish Highlands, boasts a storied heritage as one of the nation’s earliest licensed malt whisky producers. Founded in 1817 by Captain Hugh Munro - a decorated war hero who simultaneously renovated the adjacent Teaninich Castle - the site marked a pivotal shift from illicit distilling to legal operations under the Excise Act. Ownership passed through the Munro family until 1850, followed by leases to various operators, before being acquired by the Distillers Company Limited (DCL) in 1933. Subsequent mergers saw it absorbed into United Distillers in 1986 and, ultimately, Diageo in 1997, where it remains today.

The distillery’s production is characterised by its innovative setup: eschewing a traditional mash tun for a rare hammer mill and mash filter, which yields an exceptionally clear wort and higher alcohol efficiency. It employs unpeated malt, primarily from Diageo’s own sources, fermented in a mix of wooden and stainless steel washbacks over 75–80 hours. Six pot stills - three wash and three spirit, all steam-heated with reflux bowls - produce a light, grassy and oily new-make spirit at 68–69% ABV. Annual capacity stands at approximately 2.3 million litres, with 99% destined for Diageo’s blended whiskies, such as Johnnie Walker.

Brand reputation and market presence

Teaninich enjoys a solid, if understated, reputation among connoisseurs and blenders for its versatile, approachable Highland profile: expect notes of fresh grass, citrus, vanilla and subtle spice, with an oily texture that lends itself seamlessly to blends. Critics often praise its complexity despite its lightness—tasting notes from releases like the 17-year-old Special Release (2017) highlight “toffee popcorn and caramel wafers” alongside rye spice.

Market presence remains niche, with single malts comprising under 1% of output and availability limited to specialist retailers. Its primary footprint is in Diageo’s global blends, reaching over 180 countries, bolstered by the 2025 Special Releases’ “Daring Rye”, a bold single grain experiment blending rye and barley that introduces tropical, creamy notes and could elevate visibility. Overall, Teaninich appeals to enthusiasts seeking undervalued gems rather than mainstream hype.

Investment potential

Teaninich presents moderate investment allure for cask or rare bottling collectors, leveraging its scarcity and Diageo’s strategic push. With single malts historically trading at £50–£150 for core expressions, potential lies in maturing stock: its light style matures gracefully into fruity, nutty profiles after 15–20 years. The 2025 Special Releases’ 8-year-old Daring Rye, limited to 7,200 bottles at cask strength, could spark secondary market interest, mirroring the 2017 17-year-old’s 15% post-release uplift.

Financial performance

As a Diageo asset, Teaninich’s financials are embedded within the conglomerate’s whisky division, which faced headwinds in fiscal 2025 (ended 30 June 2025). Diageo reported net sales of $20.245 billion, a marginal 0.1% decline year-on-year, with organic growth at 1.7% driven by volume gains in Europe and Africa but offset by softness in North America (down 2%) and Latin America (down 1.5%). Into fiscal 2026 (Q1 results, July–September), organic net sales rose 3.5%, led by Guinness momentum and Scotch resilience, though Diageo tempered its outlook to flat or slightly lower full-year sales with low-to-mid single-digit profit growth.

Diageo’s £12 million expansion at the site signals confidence in its blending utility amid rising global demand. Broader industry challenges including tariffs, trade shifts and a 6–8% Scotch export dip in Q1 2025 temper optimism, yet the distillery’s efficiency positions it well for cost control.

Investment summary

Teaninich embodies a prudent, long-horizon play in the £6 billion Scotch investment sphere, with Diageo’s backing ensuring stability, while limited releases foster scarcity-driven appreciation. Strengths include efficient production and a burgeoning single malt narrative via 2025 innovations, potentially yielding healthy annual returns for patient investors. Ideal for balanced portfolios seeking Highland undervaluation over speculative hype.

Let's find the right casks for you.

Our team will guide you through every step, from strategy to exit.

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.