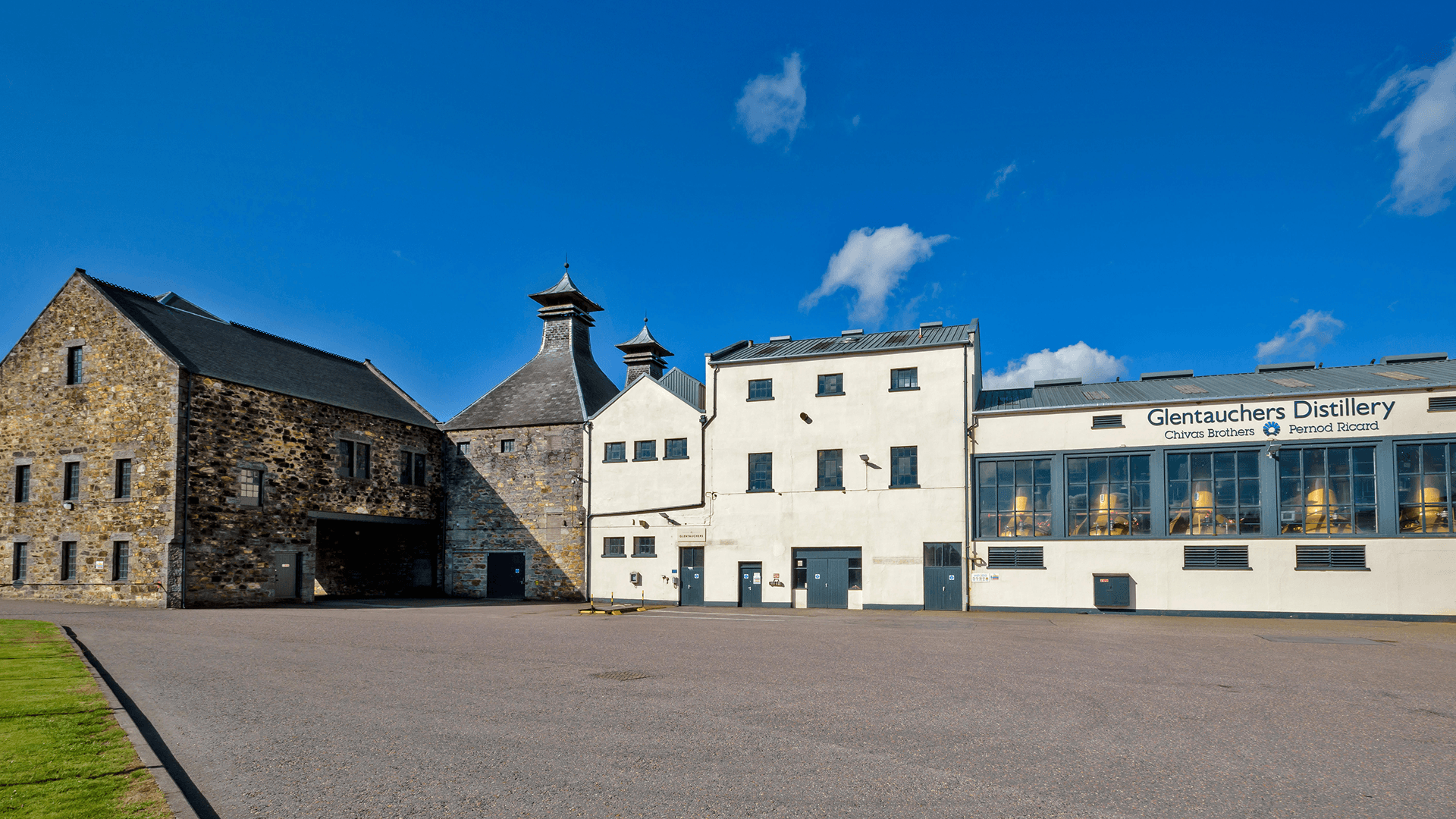

Glentauchers Distillery

Distillery key information

| Location | Speyside, Scotland, UK |

|---|---|

| Established | 1897 |

| Owner | Pernod Ricard |

| Number of Stills | 3 wash, 3 spirit |

| Visitor Centre | No |

| Status | Active |

| Website | N/A |

About Glentauchers Distillery

Glentauchers Distillery lies in the heart of Speyside, Scotland, between the villages of Mulben and Keith. Founded in 1897 by whisky blenders James Buchanan and W.P. Lowrie during a period of industry expansion, the granite distillery was designed by architect John Alcock under the guidance of Charles Doig & Son. Production began in 1898, shortly after the abolition of the malt tax, with the primary aim of supplying malt for Buchanan’s and Black & White blends. The site endured a period of closure from 1985 to 1992 before reopening under Allied Distillers. It is now owned by Chivas Brothers, a subsidiary of Pernod Ricard.

Equipped with a 12.2-tonne mash tun and six pot stills (three wash, three spirit), Glentauchers has an annual capacity of 4.2 to 4.5 million litres. The majority of its output supports major blends, notably Ballantine’s. Its spirit is characterised by a light, floral-fruity profile, achieved through 60-hour fermentations and slow, gentle distillation.

Brand reputation and market presence

Glentauchers is highly regarded as a key component in premium blended Scotch whiskies, including Buchanan’s, Black & White, Ballantine’s and Teacher’s, giving it indirect presence in over 100 global markets. Official single malt releases are rare, with most appearing through independent bottlers such as Gordon & MacPhail, Signatory Vintage and Cadenhead’s. These expressions are well received, typically scoring 84–86/100, with tasting notes of fresh fruit, malt, citrus, ginger and subtle spice.

Ballantine’s 17-year-old blend, which features Glentauchers malt, won gold as World’s Best Blended Scotch at both the 2024 World Whiskies Awards and the International Spirits Challenge. Single malts are sold primarily through specialist retailers and online platforms, with older expressions (e.g. 22-year-olds) commanding prices above £220. While single malt exports reached £2 billion in 2023, values declined 17% in 2024, yet demand for rare Speyside malts remains robust.

Investment potential

As a lesser-known Speyside distillery with limited single malt output, Glentauchers offers attractive cask investment potential. Its scarcity, combined with consistent demand from independent bottlers and the global rise in premium Scotch, supports capital appreciation.

The distillery’s casks saw an average annualised appreciation of 9.17% between 2020 and 2025 for investors who sold their casks through VCL Vintners.

The light, versatile spirit aligns with current consumer preferences for floral and fruity profiles. Its role in high-volume blends like Ballantine’s provides production stability, while aged single casks can deliver annual returns of 8–15%, in line with broader Scottish whisky investment trends. Chivas Brothers’ ongoing investment in sustainability (targeting carbon neutrality by 2025) and infrastructure upgrades further strengthens long-term prospects. Glentauchers is an option well worth considering for diversified whisky portfolios.

Financial performance

Specific financial data for the distillery is not publicly disclosed. However, its parent company, Pernod Ricard, reported global net sales of €12.1 billion for FY2024, with spirits including Scotch contributing strongly despite a 7% decline in organic growth due to market normalisation post-pandemic. Chivas Brothers continues to invest in capacity and sustainability, including renewable energy and water stewardship initiatives across its Scottish distilleries.

The broader Scotch whisky category saw export values peak in 2023 before a 2024 correction, yet long-term demand, particularly in Asia and North America, remains positive. Pernod Ricard maintains a robust balance sheet and has reaffirmed its commitment to premiumisation and portfolio resilience.

Investment summary

Glentauchers represents a stable yet under-the-radar opportunity within the Scotch whisky investment landscape. Its blend heritage ensures consistent production, while rarity in the single malt market drives collectible value. Supported by Chivas Brothers’ sustainability and capacity investments and aligned with premiumisation trends, it offers medium- to long-term growth potential with healthy annual returns for cask investors. Best suited to patient, diversified portfolios seeking exposure to Speyside’s quieter gems.

Blend dependency and macroeconomic volatility are key risks, but overall outlook remains positive amid sustained global demand for premium Scotch.

Let's find the right casks for you.

Our team will guide you through every step, from strategy to exit.

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.