Craigellachie Distillery

Distillery key information

| Location | Scotland, UK |

|---|---|

| Established | 1891 |

| Owner | John Dewar & Sons Ltd |

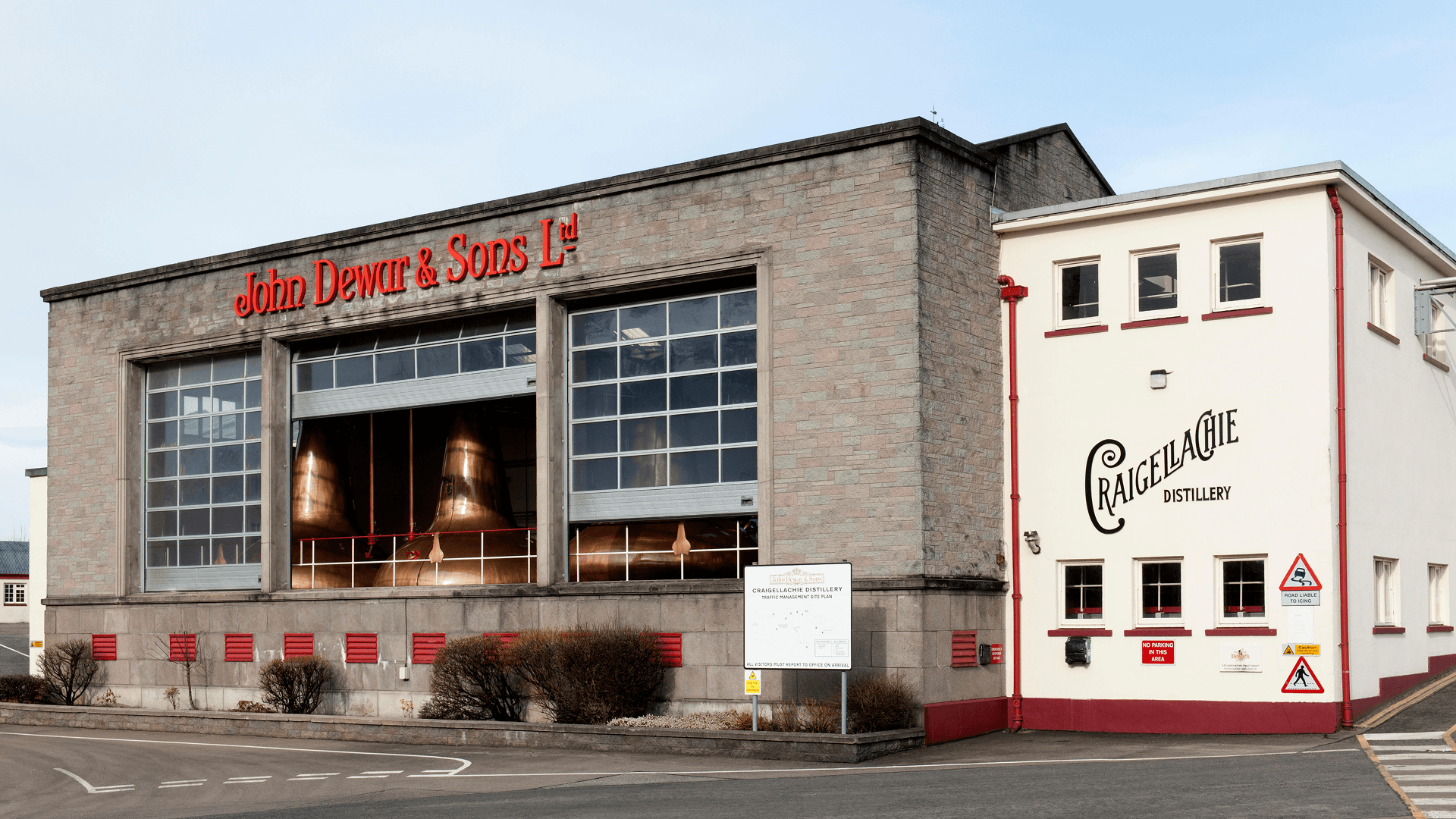

| Number of Stills | 2 wash, 2 spirit |

| Visitor Centre | Yes |

| Status | Active |

| Website | N/A |

About Craigellachie Distillery

Founded in 1891 by Alexander Edward and Peter Mackie, with architecture by Charles Doig, Craigellachie Distillery is located in the village of Craigellachie, Speyside, Scotland, overlooking the River Spey. Production began in 1891 and the distillery is now owned by Bacardi through its subsidiary John Dewar & Sons, acquired in 1998.

Renowned for its bold, fruit-forward single malts with distinctive tropical notes such as pineapple and banana, Craigellachie is a key component in Dewar’s blends, including White Horse. With an annual production capacity of 4.2 million litres, the distillery uses traditional worm tub condensers to produce a heavier, sulphury spirit, distinguishing it from lighter Speyside malts.

Bacardi’s global distribution network, spanning over 170 countries, supports Craigellachie’s presence in markets like North America and Asia, making it an attractive option for investors in the premium whisky cask market.

Brand reputation and market presence

Craigellachie is celebrated for its robust Speyside character, featuring a waxy texture and complex flavours of tropical fruit, honey and subtle sulphury notes from its worm tub condensers. Its core range includes 13-, 17- and 23-year-old expressions, with a 13-year-old Bas-Armagnac cask finish adding variety. Limited-edition releases, such as cask-strength or single-cask bottlings, are highly sought after by collectors for their rarity and rich profiles. The distillery’s single malts, representing only a small fraction of its production, enhance its exclusivity.

Distributed to over 170 countries, including the United States, Europe and Asia, Craigellachie benefits from Bacardi’s extensive marketing network. While typically closed to the public except during the Spirit of Speyside Festival, the distillery’s proximity to whisky tourism hubs like the Craigellachie Hotel bolsters its visibility.

Investment potential

Craigellachie offers a compelling opportunity for investors in the premium whisky market, supported by Bacardi’s stability and the distillery’s limited single malt output. An average annualised return of 37.73% was delivered to VCL clients who sold their Craigellachie casks during the 2020 to 2025 period.

With the majority of its 4.2 million-litre production allocated to Dewar’s blends, single malt casks are scarce, enhancing their collectability. Casks are more affordable than those of ultra-premium distilleries like Macallan, making them accessible to a broader range of investors. Limited releases, such as single-cask bottlings, drive secondary market demand due to their rarity.

The whisky cask market has shown strong growth, reflecting collectability for rare bottlings like Craigellachie’s. Bacardi’s investments, including three new aging warehouses at its Poniel blending and maturation centre in Glasgow, completed in 2024 with a 14% capacity increase, support long-term growth.

Financial performance

As part of Bacardi’s portfolio, Craigellachie’s financials are not separately disclosed but contribute to the company’s Scotch whisky revenue, including single malts Aultmore, Aberfeldy, Royal Brackla, The Deveron, Craigellachie and Dewar’s blends. In 2024, the global Scotch whisky market was valued at $34.7 billion [Fortune Business Insights], projected to reach $57.14 billion by 2032, driven by premium demand.

Bacardi’s 2024 completion of three new warehouses at its 200-acre Poniel blending and maturation centre in Glasgow, increasing capacity by 14%, enhances maturation capabilities for its portfolio, including Craigellachie. The distillery’s premium pricing supports profitability. Bacardi’s sustainability initiatives, such as energy-efficient technologies at other distilleries, align with market trends, enhancing Craigellachie’s appeal to investors.

Investment summary

Craigellachie Distillery combines Speyside heritage with bold, fruit-driven single malts, offering strong investment potential. Its limited single malt output, award-winning expressions and Bacardi’s global distribution network drive its appeal to enthusiasts and investors. Average annualised returns of 37.73%, coupled with strong growth in the rare whisky market, reflects Craigellachie’s collectability. Supported by Bacardi’s 2024 Poniel warehouse expansion and focus on premium spirits, Craigellachie offers stability and growth. Its quality, scarcity and global demand position it as a reliable choice for investors seeking a premium whisky asset.

Available casks

Let's find the right casks for you.

Our team will guide you through every step, from strategy to exit.

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.