Benrinnes Distillery

Distillery key information

| Location | Speyside, Scotland, UK |

|---|---|

| Established | 1826 |

| Owner | John Dewar & Sons Ltd |

| Number of Stills | 2 wash, 4 spirit |

| Visitor Centre | No |

| Status | Active |

| Website | N/A |

About Benrinnes Distillery

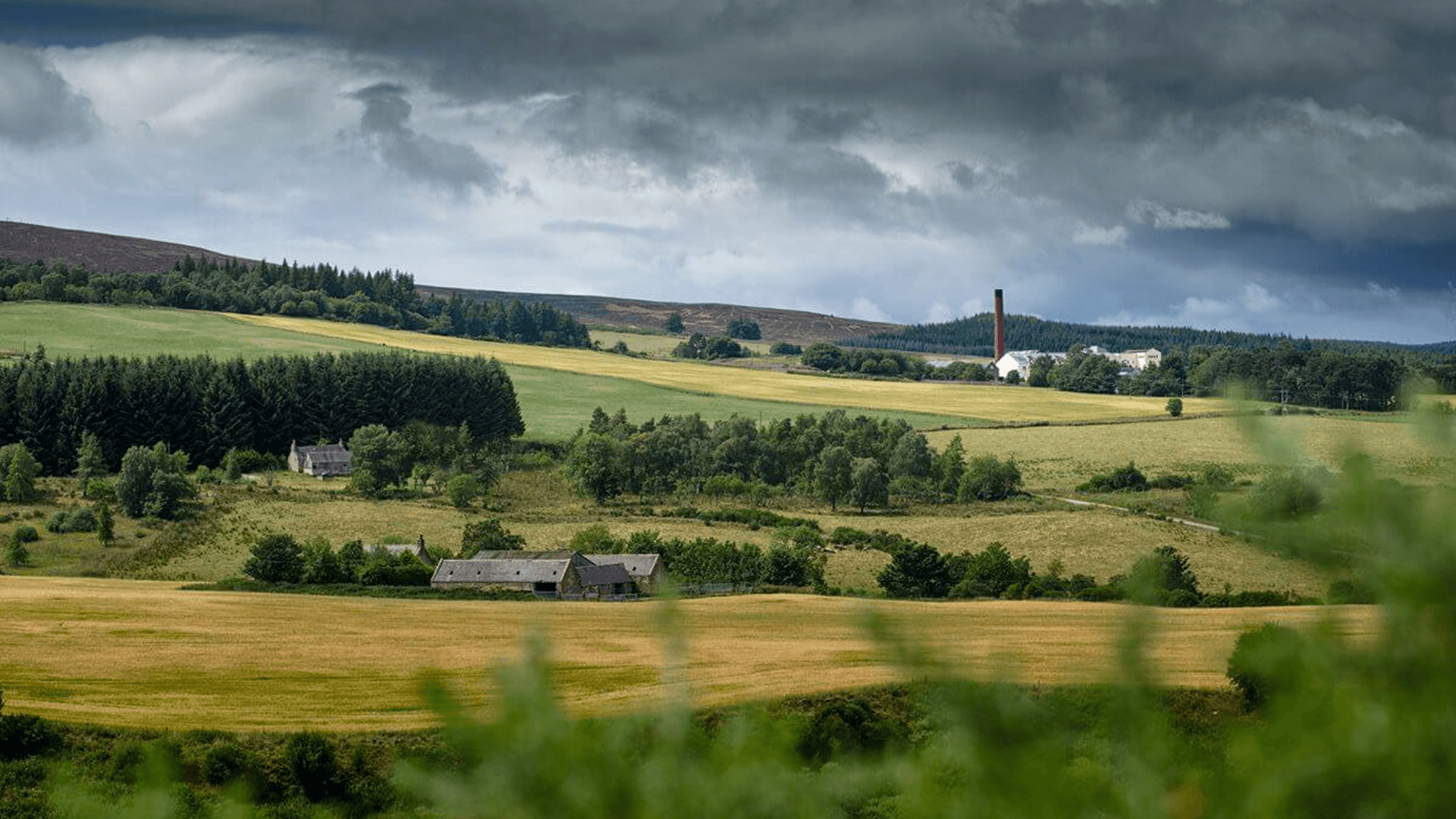

Benrinnes Distillery, located in Aberlour, Moray, at the foot of Ben Rinnes mountain in Scotland’s Speyside region, is a historic Scotch whisky producer founded in 1826 by Peter MacKenzie. Initially named Lyne of Ruthrie, the distillery was destroyed by a flood in 1829 and rebuilt in 1835 by John Innes, adopting the name Benrinnes. Its history is marked by resilience through bankruptcies, a fire in 1896 and multiple ownership changes, culminating in its acquisition by John Dewar & Sons in 1922 and integration into Diageo’s portfolio via the Distillers Company Limited in 1925, with further consolidation in 1987 and 1998.

Benrinnes operates six stills producing approximately 2.5 million litres of alcohol annually, primarily for Diageo’s blends like Johnnie Walker and J&B. The distillery draws water from the Scurran Burn, Rowantree Burn and Benrinnes Spring, contributing to its unique spirit. From 1974 to 2007, it employed a partial triple distillation process, creating a meaty, sulphury new make spirit enhanced by worm tub condensers, a rarity in modern whisky production. Since 2007, it has used traditional double distillation, increasing efficiency.

Brand reputation and market presence

Benrinnes enjoys a strong, if niche, reputation within the whisky community, particularly for its robust, meaty single malt, which contrasts with the lighter, fruitier profile typical of Speyside whiskies. Its distinctive character stems from its historical use of partial triple distillation and worm tubs, which impart a heavy, complex spirit prized by blenders and enthusiasts alike. The distillery’s primary output supports Diageo’s globally dominant blends, contributing to Benrinnes’ indirect but significant brand equity. Its Flora and Fauna 15-year-old single malt, matured in ex-Sherry casks, is a cult favourite, noted for its rich, fruity and sulphury notes, aligning it stylistically with distilleries like Mortlach and Dailuaine. Independent bottlings, numbering around one thousand, further enhance its reputation among collectors, often showcasing a lighter, floral side when matured in bourbon casks.

Benrinnes’ scarcity and unique profile have fostered a dedicated following, bolstered by Diageo’s reputation for quality and innovation in the spirits industry. The distillery’s lack of a visitor center limits its public visibility but reinforces its mystique among whisky aficionados.

Investment potential

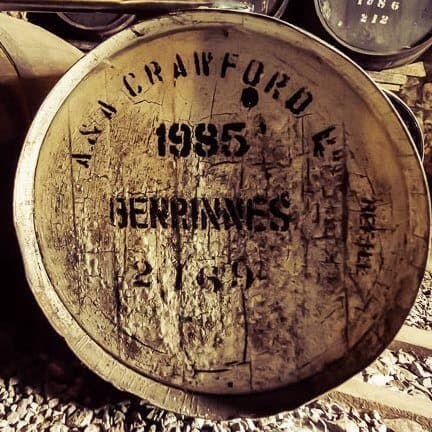

Benrinnes’ investment potential lies in its role within Diageo’s diversified portfolio and the growing whisky investment market. The distillery’s output, while not a primary single malt brand, supports Diageo’s leadership in Scotch, a category with enduring global demand. Whisky cask investments, particularly from reputable distilleries like Benrinnes, are influenced by age, rarity and brand reputation.

Benrinnes’ casks, often matured in bourbon or Sherry casks, are highly valued by independent bottlers due to their unique, meaty profile. The scarcity of official bottlings enhances their investment appeal, as rare releases like the 21-year-old Special Release 2024 command premium prices, for instance £310 for 70cl.

Financial performance

Diageo’s fiscal 2025 results provide insight into Benrinnes’ financial contribution within the company’s portfolio. Diageo reported organic net sales growth of 1.7%, reaching $20.2 billion, despite a 0.1% reported decline due to foreign exchange and acquisition/disposal impacts. Excluding the Cîroc transaction, organic growth was 1.5%, driven by 0.9% volume growth and 0.8% price/mix improvements. Scotch brands faced challenges in the US, with Johnnie Walker declining 10.6% and Buchanan’s 26%, reflecting category softness that indirectly affects Benrinnes’ blend contributions. However, Diageo grew or held market share in 65% of net sales value, reinforcing its competitive strength.

Investment summary

Benrinnes, as part of Diageo, offers a compelling case for investors seeking exposure to the resilient whisky market. Its niche single malt and critical role in blends enhance Diageo’s portfolio diversity. Diageo’s 1.7% organic sales growth, cost-saving initiatives and global market leadership provide stability. Benrinnes’ casks are a high-demand asset for whisky investors, with rarity driving value. Diageo’s stock remains a strong long-term investment, leveraging Benrinnes’ contribution to its Scotch dominance.

Available casks

Let's find the right casks for you.

Our team will guide you through every step, from strategy to exit.

Newsletter

Stay ahead of the market. Get access to exclusive offers, events, insights, and news straight to your inbox.